High Temperature Coatings Size

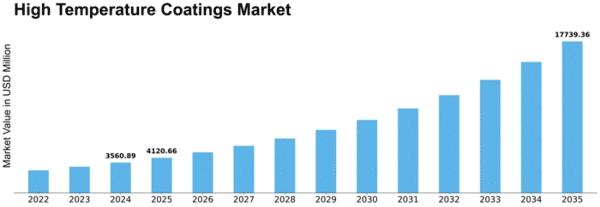

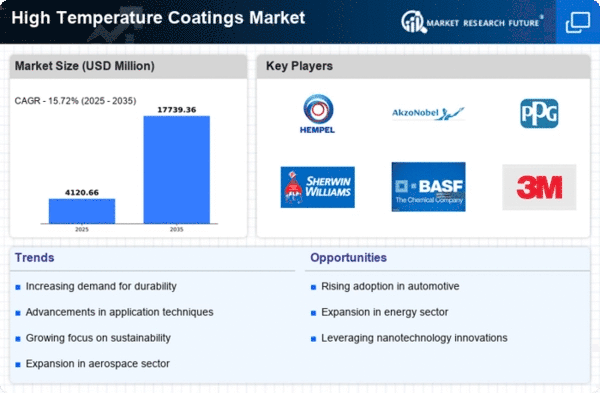

High Temperature Coatings Market Growth Projections and Opportunities

The High Temperature Coatings market as a market is affected by a number of events and factors and these come together to make the market’s dynamics. The main force, however, lies in the ever-increasing need by the sectors like aerospace, automotive, and industrial manufacturing. High Temperature Coatings, which are specifically developed to tolerate intense heat, may be a ubiquitous phenomena in the field of providing surfaces that resist heat, corrosion, and wear and tear. In aerospace industry, especially, this kind of coating is vital for components, which function at high temperatures during flight, stimulating the overall demand for this specific type of coating.

The High-Temperature Coatings Market is presumed to attain the height of USD 5.9 billion by the year 2028 growing at a CAGR of 4.9%.

Regulatory issue is one of the most-important issues in High Temperature Coatings market, especially in the field of safety, and environmental standards. Regulations such as those concerning emissions, hazardous substances, as well as work safety determine the way the high-temperature coatings are formulated and used. The manufacturers that engage in this market usually specialize in research and development, with plans that ought to satisfy the regulatory aspects, making their items fitting for the most critical areas.

World economic patterns largely determine the High Temperature Coatings market segment. Economic growth, industrial development, and higher infrastructure development brings up the need of high temperature coatings and use in industrial applications. Also, periods of recession not only are capable of temporarily harming market dynamics but also directly impact, among others, manufacturing, construction, and aerospace industries.

Technology-driven transformation and innovation are regarded as the basic drivers in the High Temperature Coatings sector. Research endeavors sustained and consequently a series of new formulations as well as significant improvements like longer durability, higher thermal resistance and lower ecological burden are created. The manufacturers that invest in developing the innovation get a leg-up above the competition by providing industry customers with the advanced solutions that meet the growing industry need that is concerned about the increased performance and the life of the product in high-temperature environments.

Raw material costs and availability as well as use of coal and natural gas play an important role in the High Temperature Coatings industry. Some of the paints are made of composite materials that are expected to weather extreme condition, and such changes in the prices fro these raw materials induce the cost of production. Businesses need to manage their mineable resource supply chains so that they stay ahead in the game and hence, do not get affected by any price fluctuations.

The market competition in the HTC (High Temperature Coatings) industry is fierce and manifold companies are struggling to get their share of the market. Companies are able to stand out from the competition through product specifications, performance, and the benefits they offer such as customization options. From strategic partnerships, collaborations and acquisitions, these are common strategies that are pursued by companies as they strive to increase their technological capabilities, product diversification, and market share in the competitive arena.

Leave a Comment