Market Trends

Key Emerging Trends in the High Temperature Elastomers Market

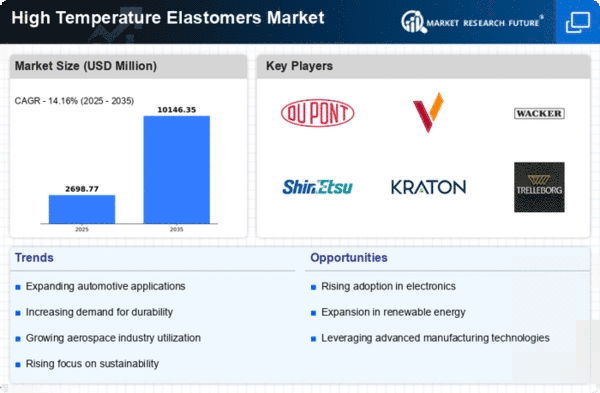

The High Temperature Elastomers Market has been undergoing significant trends and shifts recently, reflecting the transient nature of industrial environment. High temperature elastomers which are often referred to as heat-resistant polymers play a vital role in many sectors where there are extreme temperatures involved. They are specifically created to keep their elasticity even under harsh conditions hence indispensable in areas like automobiles, aircrafts, electrical/electronics and industrial manufacturing.

One such trend in the High Temperature Elastomer’s Market is the growing use of silicone elastomer materials. Silicone elastomer have excellent thermal stability characteristics as well as ageing resistance properties besides great electrical insulating ability. These qualities make them perfect for use in components such as gaskets seals used within automotives among other critical applications where there is exposure to extreme temperatures. The reason why there has been rising demand for Silicone high temperature elastomers by players such as automotive industry because a need has risen for them due engine parts or exhaust systems which are durable.

Another notable trend involves increasing focus on R&D endeavors aimed at improving performance of high temperature elastomers. Manufacturers are investing in new formulations and technologies that will enhance heat resistance as well as overall durability of the elastomeric materials. This involves exploring advanced polymer chemistries as well as innovative processing techniques to meet the changing needs of different industries’ end-users. As a result, market is being presented with high performance elastomers that can withstand more adverse temperatures.

Additionally, aerospace industry also contributes to trends in High Temperature Elastomers Market. The aerospace segment is leveraging on use of advanced materials including high temperature elastomers to develop seals, gaskets and O-rings among others due to increased demand for lightweight and fuel efficient aircrafts. These elastomers help improve the effectiveness and safety of aerospace applications by offering dependable sealing solutions in high-temperature environments such as airplane engines.

Diverse factors including technological advancements, industry-specific demands and environmental considerations are driving significant changes in the High Temperature Elastomer’s Market.The increasing use of silicone elastomers, ongoing research and development efforts, the aerospace industry's emphasis on lightweight materials, and the growing importance of sustainability are shaping the market trends in high temperature elastomers. As businesses continue to evolve calling for sturdier materials that are also eco-friendly; hence this implies that there will be continuous growth and innovation within this sector which manufacture high temperature elastomers.

Leave a Comment