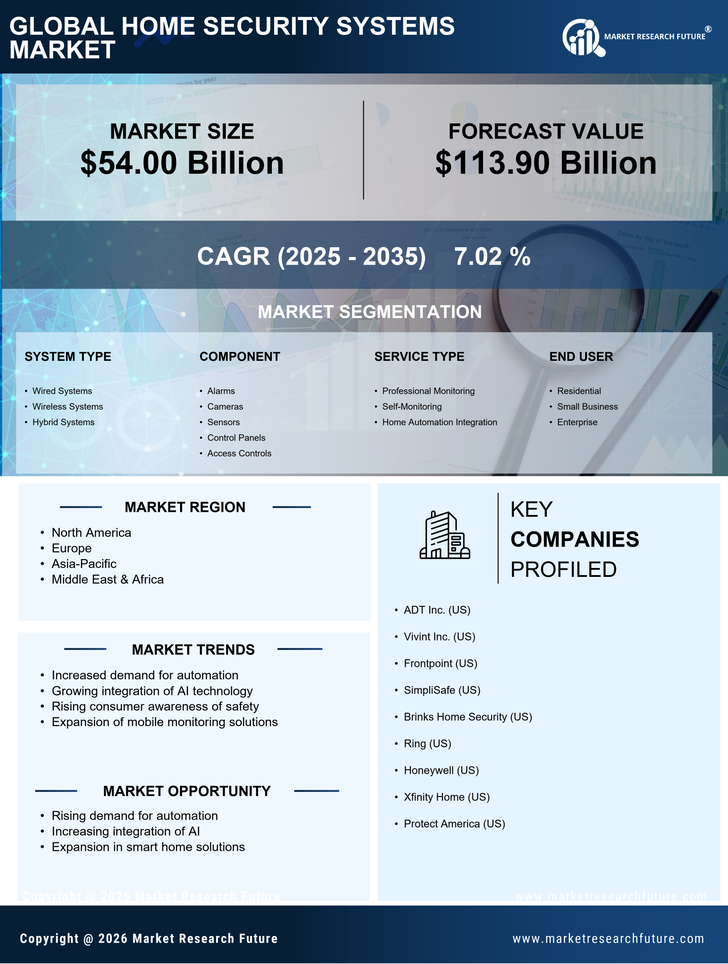

Home Security Systems Market Summary

As per Market Research Future analysis, the Home Security Systems Market was estimated at 54.0 USD Billion in 2024. The Home Security Systems industry is projected to grow from 57.79 USD Billion in 2025 to 113.9 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.02% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Home Security Systems Market is experiencing robust growth driven by technological advancements and increasing consumer awareness.

- The integration of smart technology is transforming home security systems, enhancing user experience and functionality.

- Customization and personalization are becoming essential as consumers seek tailored security solutions to meet their specific needs.

- Data privacy concerns are prompting manufacturers to adopt more secure practices in their products and services.

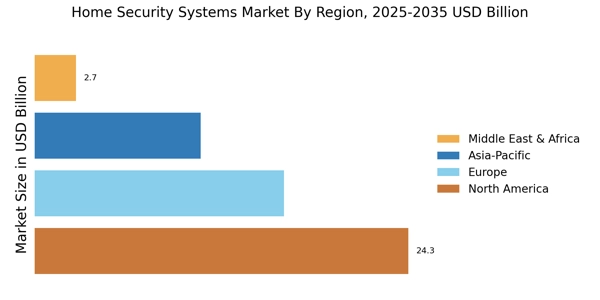

- Rising crime rates and increased awareness of home security are major drivers, particularly in North America, while the fastest-growing segment in Asia-Pacific focuses on wired systems and alarms.

Market Size & Forecast

| 2024 Market Size | 54.0 (USD Billion) |

| 2035 Market Size | 113.9 (USD Billion) |

| CAGR (2025 - 2035) | 7.02% |

Major Players

ADT Inc. (US), Vivint Inc. (US), Frontpoint (US), SimpliSafe (US), Brinks Home Security (US), Ring (US), Honeywell (US), Xfinity Home (US), Protect America (US)