Rising Security Concerns

The Global Security Systems Market Industry is experiencing growth driven by increasing security concerns across various sectors. With the rise in crime rates and terrorism threats, organizations and governments are investing heavily in security solutions. For instance, the global market is projected to reach 77.6 USD Billion in 2024, reflecting a heightened demand for advanced security systems. This trend is particularly evident in urban areas where surveillance and access control systems are being prioritized. As security threats evolve, the need for innovative technologies such as AI-driven surveillance and biometric systems becomes paramount, indicating a robust growth trajectory for the industry.

Market Growth Projections

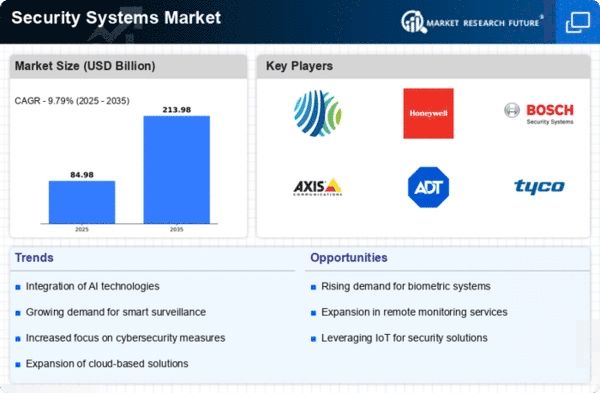

The Global Security Systems Market Industry is poised for substantial growth, with projections indicating a market value of 77.6 USD Billion in 2024 and a remarkable increase to 193.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.68% from 2025 to 2035. Such figures highlight the increasing importance of security systems across various sectors, including residential, commercial, and governmental. The anticipated growth reflects not only rising security concerns but also the ongoing advancements in technology that are reshaping the industry landscape.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Security Systems Market Industry. Innovations in artificial intelligence, machine learning, and IoT are revolutionizing security solutions, making them more efficient and effective. For example, smart surveillance systems equipped with facial recognition capabilities are gaining traction, enhancing security measures in public spaces and private properties alike. The integration of these technologies is expected to drive the market's growth, with projections indicating a compound annual growth rate of 8.68% from 2025 to 2035. As these technologies continue to evolve, they will likely redefine security protocols and enhance overall safety.

Increased Investment in Smart Cities

The concept of smart cities is gaining momentum, which is a significant driver for the Global Security Systems Market Industry. As urban areas evolve, the integration of smart technologies into city infrastructure necessitates advanced security solutions. Investments in smart city projects often include sophisticated security systems that utilize IoT and AI to monitor and manage urban safety. This trend is likely to contribute to the market's growth, with projections indicating a compound annual growth rate of 8.68% from 2025 to 2035. The focus on creating safer urban environments underscores the importance of security systems in modern city planning.

Government Initiatives and Regulations

Government initiatives and regulations significantly influence the Global Security Systems Market Industry. Many countries are implementing stricter regulations regarding safety and security, which compels businesses to upgrade their security systems. For instance, governments are mandating the installation of surveillance cameras in public areas to enhance safety. This regulatory push not only increases the demand for security systems but also fosters innovation within the industry. As a result, the market is expected to grow substantially, with estimates suggesting it could reach 193.9 USD Billion by 2035. Such initiatives indicate a proactive approach to security, further driving market expansion.

Growing Demand for Integrated Security Solutions

The demand for integrated security solutions is a notable driver in the Global Security Systems Market Industry. Organizations are increasingly seeking comprehensive security systems that combine various technologies, such as video surveillance, access control, and alarm systems, into a single platform. This integration not only enhances security but also simplifies management and reduces costs. As businesses recognize the benefits of such solutions, the market is projected to grow, with estimates suggesting it could reach 77.6 USD Billion in 2024. The shift towards integrated systems reflects a broader trend of optimizing security measures in an increasingly complex threat landscape.