Regulatory Influence

Regulatory frameworks are increasingly influencing the Horticulture Bioplastic Market. Governments worldwide are implementing stricter regulations on plastic usage, particularly in agriculture and horticulture. These regulations often promote the use of biodegradable materials, thereby creating a favorable environment for bioplastics. For example, certain regions have introduced incentives for farmers to switch to bioplastic alternatives, which can lead to a reduction in plastic pollution. Market data indicates that compliance with these regulations is becoming a priority for horticultural businesses, as non-compliance could result in penalties or loss of market access. Consequently, the regulatory landscape is driving the adoption of bioplastics, as companies seek to align with environmental standards and consumer expectations.

Technological Innovations

Technological advancements play a crucial role in shaping the Horticulture Bioplastic Market. Innovations in material science have led to the development of new bioplastics that exhibit enhanced properties, such as improved durability and biodegradability. For instance, the introduction of bioplastics that can decompose in soil conditions is gaining traction among horticulturists. Market data suggests that investments in research and development are increasing, with companies focusing on creating bioplastics that meet specific horticultural needs. These innovations not only improve the performance of horticultural products but also contribute to reducing the environmental footprint associated with plastic waste. As technology continues to evolve, the horticulture sector is likely to see a broader adoption of bioplastics, further driving market growth.

Consumer Awareness and Demand

Consumer awareness regarding environmental issues is a significant driver for the Horticulture Bioplastic Market. As individuals become more informed about the detrimental effects of plastic pollution, there is a growing demand for eco-friendly alternatives. This shift in consumer behavior is prompting horticultural businesses to seek out bioplastic solutions that align with these values. Market data reveals that a substantial percentage of consumers are willing to pay a premium for products made from sustainable materials. This trend is particularly evident in the horticulture sector, where consumers are increasingly opting for bioplastic pots and packaging. The heightened awareness not only influences purchasing decisions but also encourages companies to innovate and expand their bioplastic offerings.

Sustainable Material Adoption

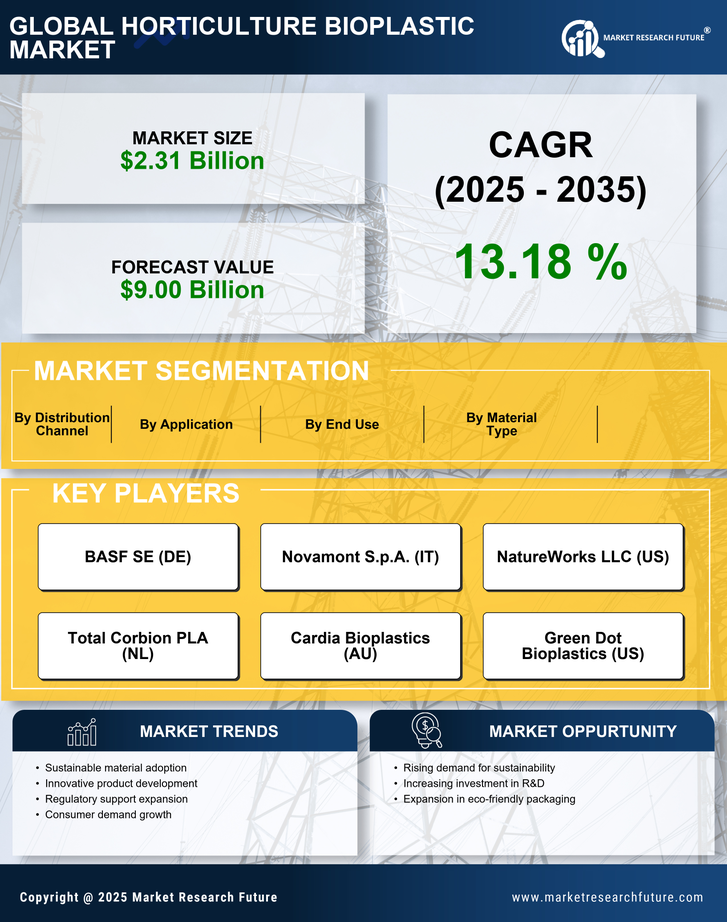

The increasing emphasis on sustainability is a primary driver for the Horticulture Bioplastic Market. As consumers and businesses alike become more environmentally conscious, the demand for sustainable materials has surged. Bioplastics, derived from renewable resources, offer a viable alternative to traditional plastics, which are often petroleum-based. This shift is reflected in market data, indicating that the bioplastics sector is expected to grow at a compound annual growth rate of over 20% in the coming years. The horticulture sector, in particular, is witnessing a notable transition towards bioplastics for applications such as pots, trays, and films. This trend not only aligns with consumer preferences but also helps companies enhance their brand image by showcasing their commitment to sustainability.

Economic Incentives and Support

Economic incentives and support mechanisms are emerging as key drivers for the Horticulture Bioplastic Market. Various governments and organizations are providing financial assistance and subsidies to promote the use of bioplastics in horticulture. These incentives can significantly lower the cost barrier for farmers and horticultural businesses looking to transition from traditional plastics to bioplastics. Market data indicates that regions with robust support programs are witnessing faster adoption rates of bioplastics. Additionally, these economic measures are fostering collaboration between stakeholders, including manufacturers, researchers, and end-users, to develop cost-effective bioplastic solutions. As financial support continues to grow, it is likely that the horticulture sector will increasingly embrace bioplastics, further propelling market expansion.