Rising Energy Demand

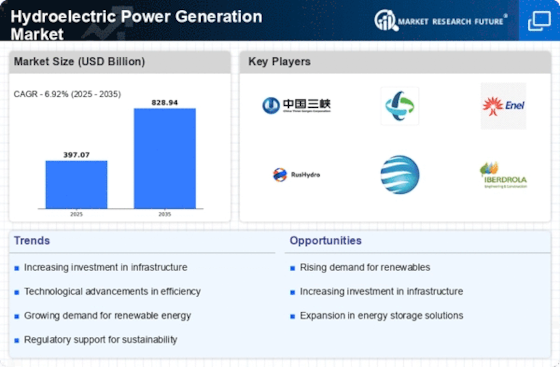

The increasing The Hydroelectric Power Generation Industry. As populations grow and economies expand, the need for sustainable and reliable energy sources intensifies. In 2023, the International Energy Agency reported that electricity demand is expected to rise by 3% annually, with renewable sources, particularly hydroelectric power, playing a crucial role in meeting this demand. Hydroelectric power plants provide a stable and efficient means of energy generation, often operating at capacity factors exceeding 40%. This trend suggests that investments in hydroelectric infrastructure are likely to increase, as countries seek to diversify their energy portfolios and reduce reliance on fossil fuels.

Technological Innovations

Technological innovations are transforming the Hydroelectric Power Generation Market, enhancing efficiency and reducing costs. Advances in turbine design, automation, and digital monitoring systems have significantly improved the performance of hydroelectric plants. For example, the introduction of variable speed turbines allows for better adaptation to fluctuating water flows, optimizing energy production. Additionally, the integration of smart grid technologies enables more effective management of electricity distribution from hydroelectric sources. As of 2023, the global market for hydroelectric technology is projected to grow, driven by these innovations that not only increase output but also minimize environmental impacts, making hydroelectric power more competitive against other energy sources.

Environmental Sustainability

The emphasis on environmental sustainability is increasingly influencing the Hydroelectric Power Generation Market. Hydroelectric power is often viewed as a cleaner alternative to fossil fuels, contributing to lower greenhouse gas emissions. In 2023, it was estimated that hydroelectric facilities accounted for approximately 16% of the world's electricity generation, highlighting their role in reducing carbon footprints. Furthermore, the development of small-scale and run-of-the-river hydro projects is gaining traction, as these options tend to have less ecological impact compared to traditional large dams. This shift towards sustainable practices aligns with global efforts to combat climate change, making hydroelectric power an attractive option for environmentally conscious investors and policymakers.

Investment in Infrastructure

Investment in infrastructure is a critical driver for the Hydroelectric Power Generation Market. As countries strive to enhance their energy security and transition to renewable sources, significant capital is being allocated to develop new hydroelectric projects and upgrade existing facilities. In 2023, it was reported that investments in renewable energy infrastructure, including hydroelectric power, reached unprecedented levels, with billions of dollars directed towards construction and modernization efforts. This influx of capital not only supports job creation in the energy sector but also fosters technological advancements that improve efficiency and reduce operational costs. The ongoing commitment to infrastructure development is likely to sustain the growth trajectory of the hydroelectric power sector.

Government Incentives and Policies

Government incentives and supportive policies are pivotal in shaping the Hydroelectric Power Generation Market. Many countries have established frameworks to promote renewable energy, including tax credits, grants, and favorable tariffs for hydroelectric projects. For instance, in 2023, several nations implemented policies aimed at increasing the share of renewables in their energy mix, with hydroelectric power being a focal point. These initiatives not only encourage investment in new projects but also facilitate the modernization of existing facilities. The commitment to achieving net-zero emissions by 2050 further underscores the importance of hydroelectric power, as it is a key component in transitioning to a low-carbon economy.