Shift Towards Home Healthcare Solutions

The trend towards home healthcare is reshaping the Hydrogel Wound Filler Market. Patients increasingly prefer receiving care in the comfort of their homes, which has led to a demand for user-friendly wound care products. Hydrogel wound fillers, known for their ease of application and effectiveness, are well-suited for home use. This shift is supported by data indicating that home healthcare services are expected to grow at a compound annual growth rate of 7.9%. As more patients manage their wound care independently, the Hydrogel Wound Filler Market is likely to expand, driven by the need for products that facilitate self-care while ensuring optimal healing outcomes. Furthermore, the convenience of hydrogel fillers aligns with the growing emphasis on patient-centered care.

Increasing Incidence of Diabetic Foot Ulcers

The rising prevalence of diabetes has led to an increase in diabetic foot ulcers, which are a significant concern in the Hydrogel Wound Filler Market. According to recent data, approximately 15% of individuals with diabetes will develop a foot ulcer at some point in their lives. This alarming statistic underscores the necessity for effective wound care solutions, including hydrogel fillers, which provide a moist healing environment. The Hydrogel Wound Filler Market is likely to experience growth as healthcare providers seek advanced treatments to manage these complex wounds. Furthermore, the increasing focus on preventive care and patient education regarding diabetes management may further drive demand for hydrogel products, as they are recognized for their efficacy in promoting healing and reducing complications associated with diabetic foot ulcers.

Aging Population and Associated Wound Care Needs

The demographic shift towards an aging population is a critical driver for the Hydrogel Wound Filler Market. Older adults are more susceptible to chronic wounds due to factors such as reduced skin elasticity, comorbidities, and prolonged immobility. As the global population aged 65 and older continues to grow, the demand for effective wound care solutions is expected to rise. Data indicates that chronic wounds affect approximately 1-2% of the elderly population, necessitating innovative products like hydrogel fillers that facilitate healing. The Hydrogel Wound Filler Market is poised to benefit from this trend, as healthcare systems adapt to meet the increasing needs of this demographic. Additionally, the integration of hydrogel wound fillers into standard care protocols for elderly patients may enhance treatment outcomes and improve quality of life.

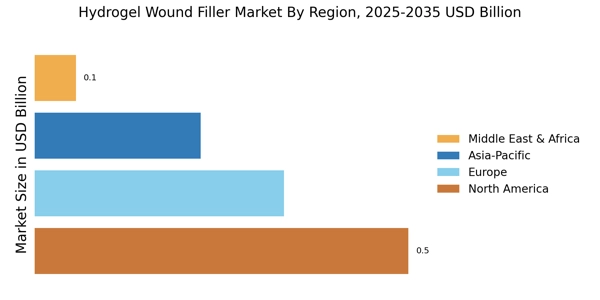

Emerging Markets and Expanding Distribution Channels

Emerging markets present a significant opportunity for the Hydrogel Wound Filler Market. As economies develop, there is an increasing demand for advanced healthcare solutions, including wound care products. The expansion of distribution channels in these regions is likely to enhance product availability and accessibility. Recent reports indicate that the wound care market in developing countries is expected to grow at a rate of 6.5% annually, driven by rising healthcare infrastructure and awareness. This growth may lead to increased adoption of hydrogel wound fillers, as healthcare providers seek effective solutions to address the rising incidence of wounds. The Hydrogel Wound Filler Market stands to benefit from this trend, as manufacturers focus on tailoring their products to meet the specific needs of emerging markets.

Rising Healthcare Expenditure and Investment in Wound Care

The upward trend in healthcare expenditure is influencing the Hydrogel Wound Filler Market positively. As countries allocate more resources to healthcare, there is a growing emphasis on advanced wound care technologies. Investment in research and development of hydrogel formulations is likely to enhance product offerings, making them more effective and accessible. Recent statistics suggest that healthcare spending is projected to increase by 5.4% annually, which may lead to greater adoption of hydrogel wound fillers in clinical settings. This financial commitment to improving patient care is expected to drive the Hydrogel Wound Filler Market, as healthcare providers seek to implement cost-effective solutions that improve healing times and reduce the overall burden of wound care.