Market Share

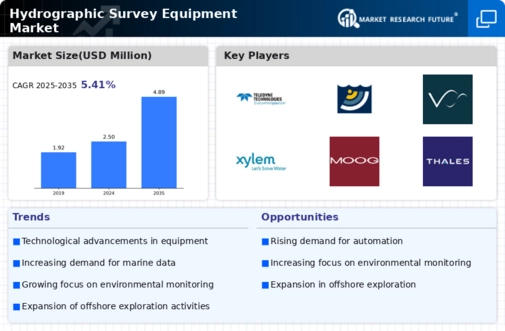

Hydrographic Survey Equipment Market Share Analysis

The hydrographic survey equipment market is characterized by noticeable tendencies that portray the changing nature of maritime activities, environmental monitoring and underwater mapping. One of the main trends is towards the adoption of cutting-edge technologies in hydrographic survey equipment. High resolution multibeam and single-beam echo sounders, LiDAR (Light Detection and Ranging) airborne systems, as well as autonomous underwater vehicles (AUVs), are now essential components in hydrographic survey systems. This marks a move to more accurate and efficient approaches of collecting data which would enable hydrographers to acquire detailed and precise information about bathymetry that can be applicable for various purposes including navigation, offshore exploration and coastal management.

Another important trend is the incorporation of artificial intelligence (AI) and machine learning (ML) into hydrographic survey data analysis. The industry has resorted to AI and ML algorithms to automate data interpretation, recognize patterns from large sets of data, thus improving efficiency on information retrieval as a result of increasing volume of collected hydrographic survey data. It ultimately results in faster interpretation process; greater accuracy when mapping submerged features; ability to detect subtle alterations at the sea floor or within water column hence providing useful hints on scientific research as well as marine infrastructure development.

Additionally, there is a rising preference for unmanned survey vessels and remotely operated vehicles (ROVs) in conducting hydrographic surveys. These platforms are either autonomous or remotely controlled with advanced sensors and other kinds of devices which facilitate their access to hazardous environments or those difficult-to-reach spots during surveys. This trend enhances surveyor productivity while reducing operational costs plus it minimizes human divers or people-operated vessels needed for certain types of surveys.

Mobile mapping systems are increasingly being sought after in Hydrographic Survey Equipment market. These integrated GNSS (Global Navigation Satellite System) based systems allow hydrographic surveyors to obtain georeferenced information even when they are on land, in shallow waters or along shores. Mobile mapping systems enhance the flexibility and speed of survey operations, providing real-time data for applications such as port and harbor management, environmental monitoring, and infrastructure planning.

Moreover, hydrographic survey equipment is affected by the global quest for environmental sustainability. The resultant demand for eco-friendly surveying equipment is linked to efforts aimed at monitoring and mitigating human influences on marine ecosystems. Hydrographic instruments that are eco-efficient in terms of their footprint, energy-saving sensors or featuring sustainable manufacturing practices gain popularity in this market segment. This trend indicates commitment of the hydrographic community to responsible and environment-friendly surveying culture.

In addition, cloud-based data management and collaboration are emerging trends in the Hydrographic Survey Equipment market. Businesses now offer options that enable reliable storage, processing and sharing of the surveyed data within online spaces. Such development helps connect teams working from different locations with each other as well as with stakeholders irrespective of geographical position through internet based platforms. Furthermore this ensures access to a large chunk of information relating to various researches and planning hydrosurveys.

Furthermore augmented reality (AR) and virtual reality (VR) technologies are being incorporated into hydrographic surveying as a trend. Through these technologies it is possible to immerse hydrographer users into three-dimensional environments where they may interact with their data about surveys in motion. The use of AR/VR utilities during interpretation processes can simplify training events meant for performing surveys; also it would be helpful if several spatial details had to be explained to people who possess dissimilar levels of understanding them.

Not only this, but there is also an increasing trend of emphasizing more on cyber security in the market. As it has turned out to be more connected and data-intensive, survey equipment finds this a necessity for securing survey data, communication channels, as well as control systems against any form of cyber threats. This trend shows the industry’s dedication to keeping the privacy and trust of hydrographic survey information safe notably in areas such as naval operations, environmental monitoring and infrastructure planning.”

Leave a Comment