North America : Technological Innovation Leader

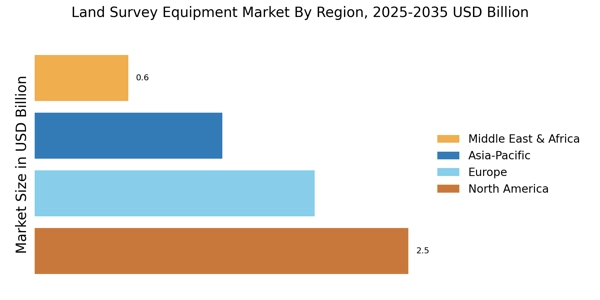

North America land survey equipment is the largest market, holding approximately 40% of the global market share. The region's growth is driven by advancements in technology, increasing infrastructure projects, and stringent regulations promoting accurate land measurement. The demand for high-precision equipment is rising, particularly in the construction and civil engineering sectors, which are bolstered by government investments in infrastructure.

The United States and Canada are the leading countries in this region, with the U.S. land survey equipment market accounting for the majority of the market share. Key players such as Trimble and Topcon dominate the competitive landscape, offering innovative solutions that cater to various surveying needs. The presence of established companies and a robust distribution network further enhance market growth, making North America a hub for land survey equipment innovation.

Europe : Regulatory-Driven Market Growth

Europe land survey equipment market is the second-largest, holding around 30% of the global market share. The region's growth is fueled by increasing investments in infrastructure, urban development, and environmental monitoring. Regulatory frameworks, such as the European Union's directives on land use and construction, are significant catalysts for demand, ensuring compliance with high standards of accuracy and safety in surveying practices.

Germany, the UK, and France are the leading countries in this market, with Germany being the largest contributor. The competitive landscape features key players like Leica Geosystems and GeoMax, which are known for their advanced technologies and comprehensive product offerings. The presence of these companies, along with a focus on sustainability and innovation, positions Europe as a critical player in the land survey equipment market.

In addition to strong performance in North America and Europe, emerging regions such as South America are expected to contribute steadily to overall market growth.”

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the land survey equipment market, accounting for approximately 20% of the global share. The region's expansion is driven by urbanization, infrastructure development, and increasing government initiatives to improve land management practices. Countries like China and India are leading this growth, supported by significant investments in construction and real estate sectors, which are essential for economic development. China is the largest market in the region, with a growing demand for advanced surveying technologies. The competitive landscape includes key players such as Sokkia and Nikon, which are expanding their presence through strategic partnerships and local manufacturing. The increasing adoption of digital technologies in surveying practices is further enhancing market dynamics, making Asia-Pacific a promising region for future growth.

Middle East and Africa : Resource-Rich Market Dynamics

The Middle East and Africa region is emerging as a significant market for land survey equipment, holding about 10% of the global market share. The growth is primarily driven by ongoing infrastructure projects, urbanization, and the need for accurate land measurement in resource management. Countries like the UAE and South Africa are at the forefront, with substantial investments in construction and mining sectors, which are critical for regional development. The competitive landscape features both local and international players, with companies like C.Scope and Riegl making notable contributions. The presence of these key players, along with government initiatives to enhance land surveying practices, is fostering a conducive environment for market growth. As the region continues to develop, the demand for advanced surveying technologies is expected to rise significantly.

.png)