Regulatory Compliance

Regulatory compliance is a significant driver in the IIoT Gateway for Utility Market. Utilities are subject to stringent regulations aimed at ensuring safety, reliability, and environmental protection. IIoT gateways assist in meeting these compliance requirements by providing accurate data collection and reporting capabilities. For example, regulations concerning emissions monitoring necessitate real-time data, which IIoT gateways can effectively deliver. The increasing complexity of regulatory frameworks is likely to propel the demand for IIoT gateways, as utilities seek solutions that simplify compliance processes and reduce the risk of penalties.

Focus on Cybersecurity

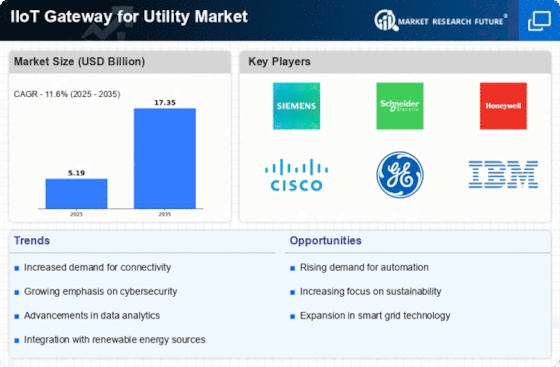

In the IIoT Gateway for Utility Market, the increasing focus on cybersecurity is becoming a critical driver. As utilities adopt IIoT solutions, they face heightened risks of cyber threats that could compromise sensitive data and operational integrity. Consequently, there is a pressing need for robust security measures integrated within IIoT gateways. The market for cybersecurity solutions in the utility sector is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 10%. This emphasis on cybersecurity not only protects utilities but also fosters consumer trust, thereby propelling the adoption of IIoT gateways.

Sustainability Initiatives

Sustainability initiatives are increasingly influencing the IIoT Gateway for Utility Market. Utilities are under pressure to reduce their carbon footprints and enhance energy efficiency. IIoT gateways play a pivotal role in this transition by enabling real-time monitoring and management of energy consumption. For instance, the implementation of smart grids facilitated by IIoT gateways can lead to a reduction in energy waste by approximately 20%. This alignment with sustainability goals not only meets regulatory requirements but also appeals to environmentally conscious consumers, thereby driving the demand for IIoT gateways in the utility sector.

Enhanced Operational Efficiency

Enhanced operational efficiency is a key driver in the IIoT Gateway for Utility Market. Utilities are continuously seeking ways to streamline their operations and reduce costs. IIoT gateways facilitate this by enabling predictive maintenance, real-time monitoring, and automated control systems. By leveraging data analytics, utilities can identify inefficiencies and optimize resource allocation. Reports indicate that utilities implementing IIoT solutions can achieve operational cost reductions of up to 25%. This drive towards efficiency not only improves profitability but also enhances service delivery, thereby fostering greater adoption of IIoT gateways.

Integration of Advanced Technologies

The IIoT Gateway for Utility Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics. These technologies enhance the capabilities of IIoT gateways, enabling utilities to process vast amounts of data in real-time. As a result, utilities can optimize their operations, improve decision-making, and enhance customer service. According to recent data, the adoption of AI in utility operations is projected to increase efficiency by up to 30%. This trend indicates a growing reliance on IIoT gateways to facilitate seamless communication between devices and systems, ultimately driving the market forward.