Increased Focus on Cybersecurity

As data breaches and cyber threats become more prevalent, there is a heightened focus on cybersecurity within the big data-software market. Organizations are increasingly aware of the need to protect sensitive data and comply with regulatory requirements. This awareness is driving investments in big data solutions that incorporate robust security features. The cybersecurity market in India is projected to grow at a CAGR of over 20% in the coming years, reflecting the urgency for enhanced data protection measures. Consequently, the big data-software market is likely to evolve, with a growing emphasis on integrating security protocols into data management practices, ensuring that organizations can safeguard their data assets effectively.

Growing Demand for Data Analytics

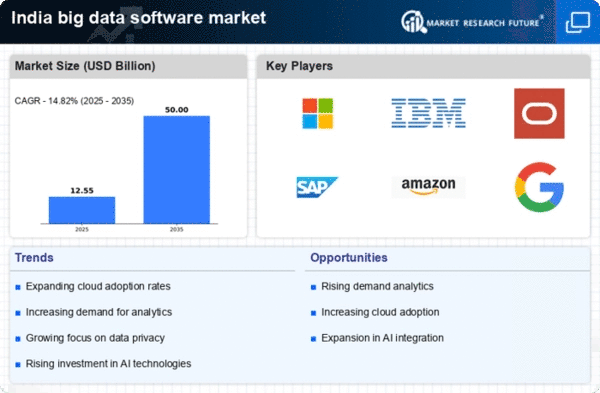

The increasing reliance on data-driven decision-making is propelling the big data-software market in India. Organizations across various sectors are recognizing the value of data analytics to enhance operational efficiency and customer engagement. According to recent estimates, the analytics market in India is projected to reach approximately $16 billion by 2025, indicating a robust growth trajectory. This demand is driven by the need for actionable insights, which are essential for strategic planning and competitive advantage. As businesses strive to harness the power of data, the big data-software market is likely to experience significant expansion, with companies investing in advanced analytics tools to meet their evolving needs.

Government Initiatives and Support

The Indian government is actively promoting the adoption of big data technologies through various initiatives aimed at enhancing digital infrastructure and data literacy. Programs such as Digital India and Smart Cities Mission are fostering an environment conducive to the growth of the big data-software market. By investing in data analytics capabilities, the government aims to improve public services and governance. Furthermore, the establishment of data centers and cloud infrastructure is likely to facilitate the deployment of big data solutions across sectors. This supportive regulatory framework is expected to drive innovation and investment in the big data-software market, positioning India as a key player in the global data landscape.

Emergence of Startups and Innovation Hubs

India's vibrant startup ecosystem is playing a crucial role in shaping the big data-software market. Numerous startups are emerging with innovative solutions that cater to diverse industry needs, from healthcare to finance. This influx of new players is fostering competition and driving technological advancements in big data analytics. According to industry reports, the number of data analytics startups in India has increased significantly, with many attracting substantial funding. This trend indicates a growing recognition of the importance of data-driven solutions. As these startups continue to innovate, they are likely to contribute to the expansion of the big data-software market, offering unique products and services that address specific challenges faced by businesses.

Rise of E-Commerce and Digital Transformation

The rapid growth of e-commerce in India is significantly influencing the big data-software market. With the digital transformation of businesses, there is an increasing volume of data generated from online transactions, customer interactions, and supply chain operations. This surge in data necessitates sophisticated big data solutions to analyze and derive insights. Reports suggest that the Indian e-commerce market is expected to reach $200 billion by 2026, further amplifying the demand for big data software. Companies are leveraging these tools to optimize their operations, enhance customer experiences, and drive sales, thereby contributing to the overall growth of the big data-software market.