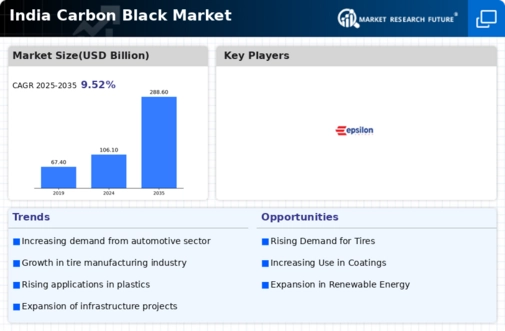

Top Industry Leaders in the India Carbon Black Market

India Carbon Black Market

The India Carbon Black Market focuses on the production and consumption of carbon black, a versatile industrial material used as a reinforcing filler in rubber products, pigments in inks and coatings, and as a conductive agent in batteries and electronics. This market reflects the demand from automotive, construction, and manufacturing sectors in India for enhancing product performance and sustainability.

Market Players and Strategies:

-

Established Domestic Players: Birla Carbon, the world's largest producer, dominates the Indian market with a significant share. They focus on continuous innovation, expanding production capacity, and a strong distribution network. -

Global Giants: Cabot Corporation and Aditya Birla Chemicals (acquired Columbian Chemicals Company) are major competitors, employing strategies like technological advancements and a global reach to secure market share. -

New Entrants: Phillips Carbon Black Ltd. (PCBL) recently commissioned a new plant in Tamil Nadu, India, aiming to disrupt the market with a focus on high-quality, specialty carbon blacks and sustainable production practices.

Factors Influencing Market Share:

-

Product Quality and Consistency: Indian tire manufacturers require high-quality carbon black for performance and durability. Players offering consistent quality across product lines gain an edge. -

Cost Competitiveness: Pricing plays a crucial role. Manufacturers strive for efficient production processes and economies of scale to offer competitive pricing. -

Brand Reputation and Trust: Established brands with a history of reliability and strong customer relationships hold a significant advantage. -

Distribution Network and Customer Service: A robust distribution network ensures timely delivery and efficient logistics. Responsive customer service builds trust and fosters long-term partnerships. -

Sustainability Focus: Growing environmental concerns are pushing companies to adopt sustainable practices throughout the production process. Investing in cleaner technologies and offering eco-friendly carbon black grades is becoming a key differentiator.

Key Companies in the Indian Carbon Black market include

- Phillips Carbon Black Limited (PCBL)

- Birla Carbon India Pvt. Ltd.

- Balkrishna Industries Limited (BKT)

- Himadri Specialty Chemical Ltd.

- Continental Carbon India Private Limited

- Ralson Shine Carbon Ltd.

- Epsilon Carbon Private Limited

- Cabot Corporation

- Selective Minerals and Color Industries Pvt. Ltd.

Recent Developments

November 2023: The Indian tire industry witnessed a slight decline in demand due to global economic uncertainties. This impacted the demand for carbon black but to a lesser extent.

December 2023: Birla Carbon announced a strategic partnership with a European tire manufacturer to develop a new generation of sustainable carbon black grades.

January 2024: The Indian government introduced new regulations for carbon black production aimed at reducing environmental impact. This could lead to increased production costs for some players.

February 2024: The Indian automobile industry showed signs of recovery, leading to a renewed rise in demand for carbon black, particularly for grades used in passenger car tires.