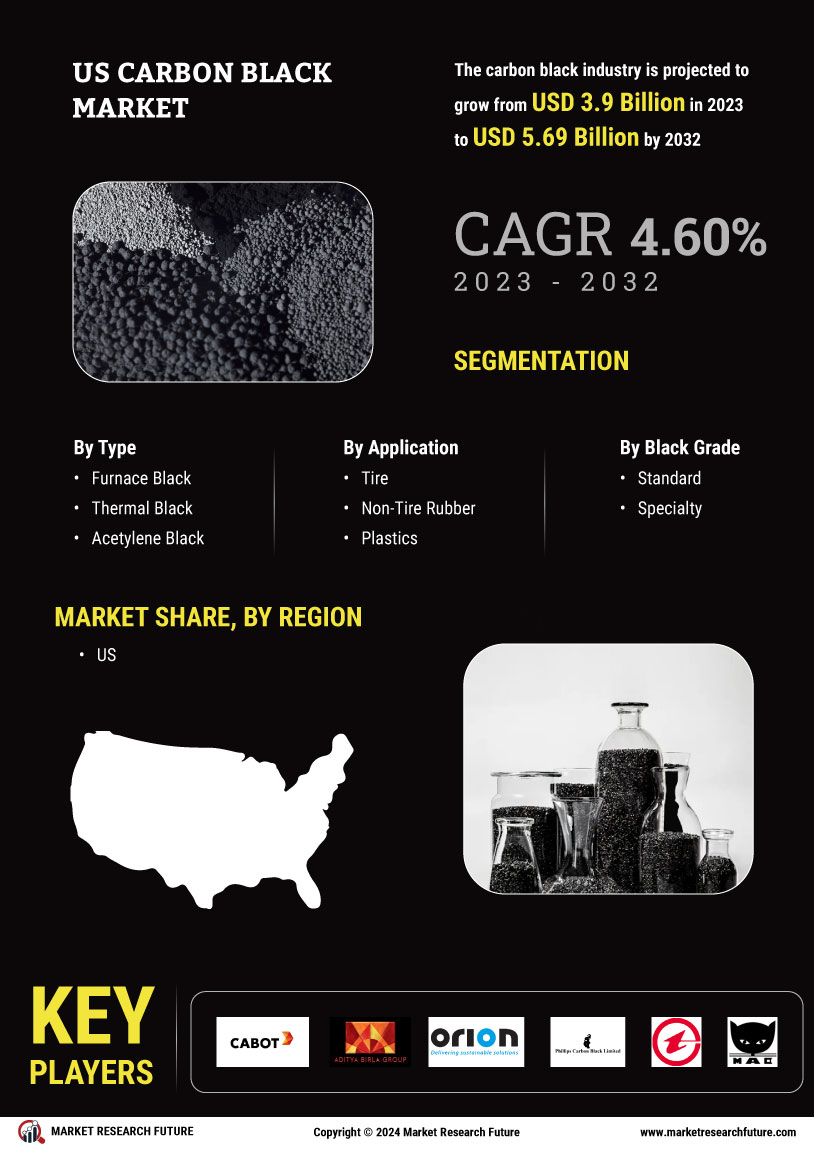

Expansion of Tire Manufacturing

The US Carbon Black Market is significantly influenced by the expansion of tire manufacturing facilities within the country. As major tire manufacturers invest in new production plants and upgrade existing ones, the demand for carbon black is expected to rise correspondingly. In 2025, it is estimated that tire manufacturing will represent a substantial portion of the carbon black market, with projections indicating a growth rate of approximately 4% annually. This expansion is driven by the increasing consumer demand for tires that offer enhanced performance and safety features. Moreover, the integration of innovative technologies in tire production may further elevate the need for specialized carbon black grades, thereby reinforcing the US Carbon Black Market.

Growth in Construction Activities

The US Carbon Black Market is poised to benefit from the ongoing growth in construction activities across the nation. As infrastructure projects gain momentum, the demand for construction materials that incorporate carbon black, such as asphalt and concrete, is expected to rise. In 2025, the construction sector is anticipated to contribute around 15% to the overall carbon black consumption in the United States. The increasing focus on durable and high-performance construction materials aligns with the properties of carbon black, which enhances strength and longevity. Furthermore, the trend towards sustainable construction practices may also drive the adoption of carbon black in eco-friendly building materials, thereby positively impacting the US Carbon Black Market.

Increasing Environmental Regulations

The US Carbon Black Market is also affected by the increasing environmental regulations aimed at reducing emissions and promoting sustainability. Stricter regulations on industrial emissions are prompting carbon black manufacturers to adopt cleaner production technologies. In 2025, compliance with these regulations is expected to drive investments in sustainable practices, potentially leading to a shift in production methods. While this may initially increase operational costs, it could also create opportunities for manufacturers to differentiate their products in a market that increasingly values sustainability. As a result, the US Carbon Black Market may witness a transformation that aligns with environmental goals while still meeting the growing demand for carbon black.

Rising Demand from Automotive Sector

The US Carbon Black Market experiences a notable surge in demand driven by the automotive sector. As vehicle production increases, the need for carbon black, a critical component in tire manufacturing, escalates. In 2025, the automotive industry is projected to account for approximately 60% of the total carbon black consumption in the United States. This trend is further fueled by the growing preference for high-performance tires, which require specialized grades of carbon black. Additionally, the shift towards electric vehicles may also influence the market, as these vehicles often utilize advanced materials that incorporate carbon black. Consequently, the automotive sector's expansion is likely to bolster the US Carbon Black Market significantly.

Technological Innovations in Production

Technological innovations in the production of carbon black are reshaping the US Carbon Black Market. Advances in manufacturing processes, such as the adoption of more efficient and environmentally friendly methods, are likely to enhance production capabilities. In 2025, it is anticipated that these innovations will lead to a reduction in production costs and an increase in output quality. Furthermore, the development of new carbon black grades tailored for specific applications, such as electronics and coatings, may open new avenues for market growth. As manufacturers strive to meet evolving consumer demands, the emphasis on technological advancements will play a crucial role in shaping the future landscape of the US Carbon Black Market.