Us Carbon Black Size

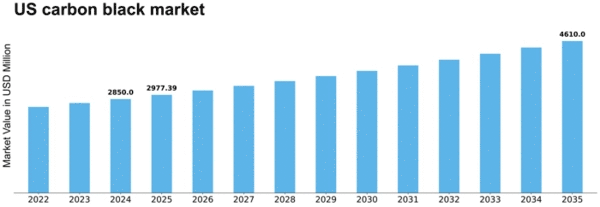

US Carbon Black Market Growth Projections and Opportunities

The US Carbon Black Market is shaped by various market factors contributing to its growth and dynamics. A primary driver is the robust demand from the tire manufacturing industry, which is the largest consumer of carbon black. Carbon black serves as a crucial reinforcing filler in tire production, enhancing mechanical properties such as wear resistance, tensile strength, and longevity. As the automotive industry continues to thrive, the demand for tires, and consequently carbon black, remains consistently high. The cyclical nature of the automotive sector and trends in vehicle production significantly influence the dynamics of the US Carbon Black Market.

Moreover, the plastics and rubber industries play a substantial role in driving the demand for carbon black. Carbon black is used as a pigment and reinforcing agent in various plastic and rubber products, contributing to their strength and UV resistance. The growth of these industries, driven by factors such as consumer goods manufacturing, construction activities, and infrastructure development, positively impacts the carbon black market in the United States. The versatility of carbon black in enhancing the properties of plastics and rubber makes it an integral component in these sectors.

Technological advancements in carbon black production processes contribute to market dynamics. Innovations in furnace technology and the development of sustainable production methods aim to improve the efficiency, cost-effectiveness, and environmental impact of carbon black manufacturing. As industries increasingly focus on sustainability and eco-friendly practices, advancements in green carbon black technologies, such as those derived from renewable sources, become influential factors shaping the market.

Global economic conditions and trade dynamics impact the US Carbon Black Market. Carbon black is a globally traded commodity, and factors such as international trade agreements, tariffs, and geopolitical events can influence the supply chain and market conditions. Economic stability and trade policies play a role in determining the accessibility and cost competitiveness of carbon black materials in the US market.

Environmental considerations and regulatory standards also influence the carbon black market. Stringent environmental regulations regarding emissions from carbon black manufacturing plants and the need to comply with air quality standards contribute to the adoption of cleaner production technologies. Companies in the US carbon black industry invest in technologies that reduce emissions and enhance sustainability, aligning with regulatory requirements and broader environmental goals.

Market competition and industry consolidation are notable factors shaping the US Carbon Black Market. The market comprises a mix of large multinational corporations and regional players, fostering competitive pricing strategies, technological innovations, and market expansions. Mergers, acquisitions, and collaborations are common as companies seek to enhance their market share, product portfolios, and global reach. The competitive landscape encourages innovation and drives advancements in carbon black technologies.

Challenges related to the fluctuation in raw material prices, regulatory compliance, and the adoption of sustainable practices are factors that the carbon black industry addresses. The prices of key raw materials, such as crude oil and natural gas, can impact the overall production costs of carbon black. Additionally, compliance with environmental regulations requires ongoing investments in cleaner technologies. The industry's commitment to addressing these challenges contributes to the sustainable growth of the carbon black market in the United States.

Leave a Comment