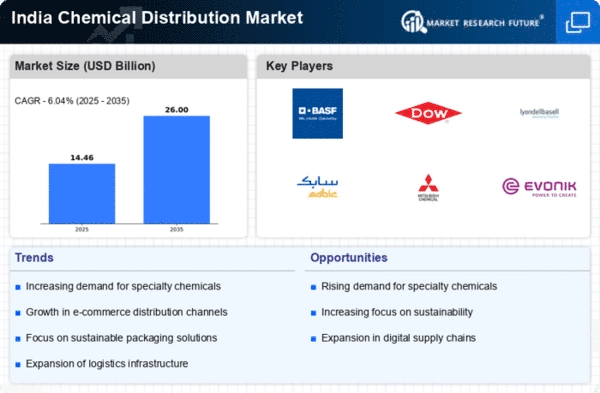

The chemical distribution market in India is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as agriculture, pharmaceuticals, and manufacturing. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and digital transformation to enhance their market positions. Companies like BASF (DE), Dow (US), and SABIC (SA) are at the forefront, leveraging their extensive product portfolios and technological capabilities to meet the evolving needs of customers. Their collective focus on sustainability and efficiency is reshaping the competitive environment, fostering a climate where adaptability and responsiveness are paramount.In terms of business tactics, localizing manufacturing and optimizing supply chains are critical strategies employed by these companies. The market appears moderately fragmented, with a mix of large multinational corporations and smaller regional players. This structure allows for a diverse range of offerings, yet the influence of major players like LyondellBasell (US) and Univar Solutions (US) is significant, as they set benchmarks for quality and service standards that others strive to meet.

In October BASF (DE) announced a strategic partnership with a leading Indian agricultural firm to develop sustainable crop protection solutions. This collaboration is poised to enhance BASF's footprint in the agricultural sector, aligning with global trends towards sustainable practices. The partnership not only strengthens BASF's market position but also reflects a broader industry shift towards environmentally friendly products, which are increasingly demanded by consumers and regulators alike.

In September Dow (US) unveiled a new digital platform aimed at streamlining its supply chain operations in India. This initiative is expected to enhance operational efficiency and reduce lead times, thereby improving customer satisfaction. The move underscores Dow's commitment to digital transformation, which is becoming a critical differentiator in the competitive landscape, as companies seek to leverage technology for better service delivery and cost management.

In August SABIC (SA) expanded its production capacity in India by investing in a new facility dedicated to specialty chemicals. This expansion is indicative of SABIC's long-term strategy to cater to the growing demand for high-performance materials in various industries. By increasing its local production capabilities, SABIC not only enhances its supply chain resilience but also positions itself to respond more effectively to regional market needs.

As of November the competitive trends in the chemical distribution market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in navigating complex market dynamics. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancement, and supply chain reliability. This shift suggests that companies that prioritize these areas will be better positioned to thrive in an increasingly competitive environment.