Growing Export Opportunities

The India color sorter market is poised to benefit from the increasing export opportunities for agricultural products. As global demand for Indian agricultural goods rises, producers are under pressure to enhance product quality and presentation. Color sorting technology plays a crucial role in meeting international quality standards, making it an essential investment for exporters. Recent data shows that India's agricultural exports have grown by 18% in the last year, highlighting the potential for color sorting machines to facilitate this growth. As exporters strive to maintain competitiveness in the global market, the demand for advanced color sorting solutions is likely to increase, further propelling the growth of the color sorter market in India.

Government Initiatives and Support

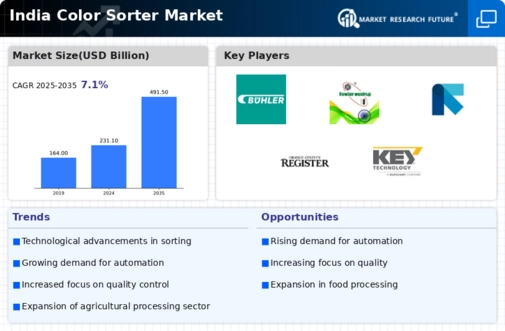

The India color sorter market is benefiting from various government initiatives aimed at enhancing agricultural productivity and food safety. Programs promoting the adoption of modern agricultural practices, including the use of color sorting technology, are being implemented to support farmers and food processors. The government has allocated funds for research and development in agricultural technologies, which includes color sorting machines. Additionally, policies encouraging the establishment of food processing units are likely to create a favorable environment for the color sorter market. As a result, the market is expected to witness a compound annual growth rate (CAGR) of around 10% over the next five years, driven by these supportive measures.

Rising Demand for Quality Products

The growing consumer awareness regarding product quality is significantly influencing the India color sorter market. As consumers increasingly prefer high-quality food products, manufacturers are compelled to adopt advanced sorting technologies to meet these expectations. The demand for premium grains, pulses, and other agricultural products has surged, prompting producers to invest in color sorting machines to ensure product consistency and quality. Market data indicates that the demand for high-quality sorted products has increased by approximately 15% over the past year. This trend is likely to continue, as both domestic and international markets place a premium on quality, thereby driving the growth of the color sorter market in India.

Increasing Investment in Food Processing Sector

The food processing sector in India is witnessing substantial investment, which is positively impacting the India color sorter market. With the government's focus on enhancing food processing capabilities, there has been a surge in funding from both domestic and foreign investors. This influx of capital is facilitating the acquisition of advanced sorting technologies, which are essential for maintaining quality and efficiency in food processing. Recent statistics suggest that the food processing industry is projected to grow at a CAGR of 12% in the coming years, thereby creating a robust demand for color sorting machines. This trend indicates a promising future for the color sorter market as food processors seek to improve their operational efficiency.

Technological Advancements in Sorting Technology

The India color sorter market is experiencing rapid technological advancements that enhance sorting efficiency and accuracy. Innovations such as machine learning and artificial intelligence are being integrated into sorting machines, allowing for real-time data analysis and improved decision-making. This technological evolution is expected to drive market growth, as manufacturers seek to optimize production processes and reduce waste. According to recent data, the adoption of advanced sorting technologies has led to a 20% increase in sorting accuracy, which is crucial for industries like agriculture and food processing. As these technologies become more accessible, smaller enterprises in India are also likely to invest in color sorting solutions, further expanding the market.