Research Methodology on Optical Sorter Market

Introduction

This research report on the Optical Sorter Market 2023-2030 has been conducted utilizing primary and secondary sources in both qualitative and quantitative manners. Primary research sources such as subject matter experts, primary respondents, senior executives, conferences and seminars, and industry professionals were consulted for gaining insights into the market and industry-related information. Secondary research sources such as the statistical database, regulatory bodies, market tracker databases and directories have been referred to.

Research Objectives

The report offers an in-depth understanding of the Optical Sorter Market, backed by a comprehensive data collection, analysis, and interpretation of primary and secondary data. The research objectives are:

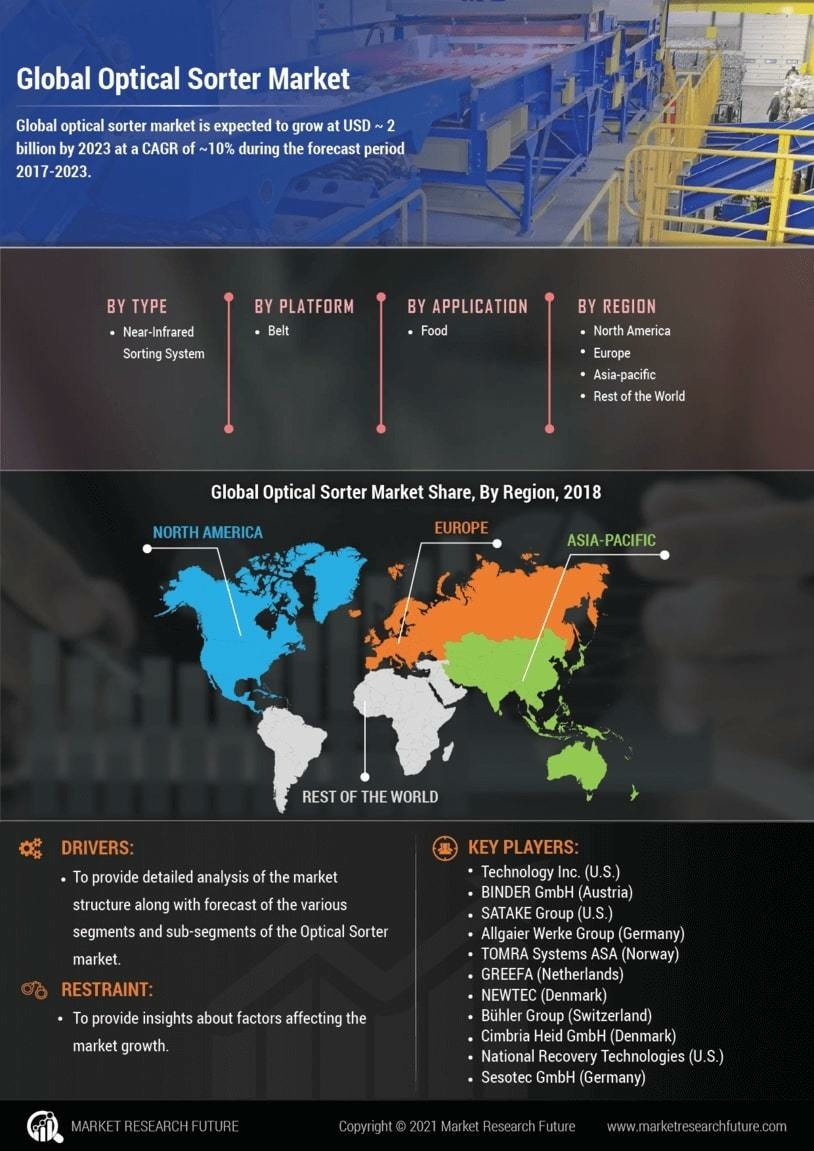

- To identify the major stakeholders in the Optical Sorter Market and gain insights into their market strategies

-To recognize the growth drivers, challenges, and opportunities that influence the market

- To analyze the past and current trends that shape the Optical Sorter Market's future

- To identify key trends, drivers, and influences impacting the global market

- To evaluate the impact of different market factors on the market's growth

- To develop a holistic view of the Optical Sorter Market's outlook

Research Scope

The research report's scope covers qualitative, quantitative, and primary market analysis from 2023-2030, along with geographic scope including global and regional market analysis.

Research Methodology

The study is based on extensive research using a combination of both primary and secondary sources. Primary sources include surveys, interviews, and observations of experienced professionals. Secondary sources include trade journals, industry databases, market report repositories, and other published reports. The research process used in the report is based on three steps: (1) Extensive secondary research, (2) Primary research, and (3) Modelling and analytical validation.

Primary Research

Primary research involved interviews and surveys using a combination of standard methodology and powerful online outlets to gather qualitative and quantitative data from industry experts, primary respondents, and other key individuals.

Secondary Research

Secondary research included exploring key industry sources such as online databases, government sources, whitepapers, industry journals and other associated sources. Data from public sources, such as press releases, company reports, and public filings, was also integrated into the research.

Data Collection and Analysis

Data is collected from both primary and secondary sources. A three-phase approach was used to ensure the accuracy and reliability of the data. Firstly, data is collected and organized into easy-to-analyze layouts. Secondly, market estimates and forecasts were derived through the analysis of the collected data. Finally, the report was double-checked for accuracy, authenticity, and consistency.

Market Forecasts

The market studies and forecasts were conducted using the most accurate market intelligence tools and techniques. A bottom-up and top-down market analysis was used, along with both quantitative and qualitative methods, to accurately forecast the global market. The forecasts rely on historical data, current conditions, and future trends, as well as individual company financial performance. The forecasts also take into consideration the impact of macroeconomic and political factors on the global market.

This report also provides a detailed understanding of the competitive environment and market dynamics impacting the Optical Sorter Market. Porter's five forces analysis, PEST analysis, and seven-step market entry strategy are also covered in this report.

Data Triangulation

Data triangulation is used to ensure the accuracy and reliability of the collected data. This process involves collecting data from both primary and secondary sources and identifying discrepancies within the data. The data was further validated with the help of industry experts and professionals.

Assumptions and Reasons for Studying the Market

The research study and report were prepared after taking into consideration the following assumptions:

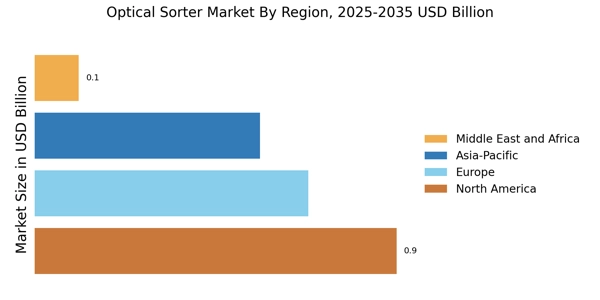

- The geographical scope of this report is global and primarily covers the major countries affected by the optical sorter market through 2030.

- Factors influencing the market include demographic, economic and market trends affecting the optical sorter's market size, particularly in the United States, Europe, China, Japan, India, and Southeast Asian countries.

- The report takes into account the influence of government regulations and policies, technological advancements and other industry trends.

- Data used in this report is provided in conformity with the global optical sorter market's definition and scope.

- The research study provides an in-depth outlook of the optical sorter market over the forecast period 2023 to 2030.

In conclusion, this research was conducted to gain a thorough understanding of the Optical Sorter Market's dynamics and trends and to develop market forecasts for the period 2023-2030. The insights and data provided can help industry participants make informed decisions to drive their business growth.