Government Initiatives and Support

The India Geographic Atrophy Ga Market benefits from various government initiatives aimed at improving eye health and increasing access to treatment. The National Programme for Control of Blindness and Visual Impairment (NPCBVI) has been instrumental in raising awareness about eye diseases, including geographic atrophy. This program promotes early detection and treatment, which is crucial for managing the condition effectively. Additionally, the government has been collaborating with non-governmental organizations to enhance screening and treatment facilities across the country. Such initiatives not only aim to reduce the burden of visual impairment but also create a conducive environment for the growth of the India Geographic Atrophy Ga Market. The financial support for research and development in ophthalmology further indicates a commitment to advancing treatment options.

Growing Demand for Personalized Medicine

The trend towards personalized medicine is gaining traction within the India Geographic Atrophy Ga Market. Patients are increasingly seeking tailored treatment options that cater to their specific genetic and phenotypic profiles. This shift is partly driven by advancements in genomics and biotechnology, which allow for a better understanding of individual responses to therapies. As healthcare providers begin to adopt personalized approaches in managing geographic atrophy, the demand for customized treatment plans is likely to grow. This evolution may lead to the development of more effective therapies that align with the unique needs of patients, thereby enhancing the overall efficacy of treatments in the India Geographic Atrophy Ga Market.

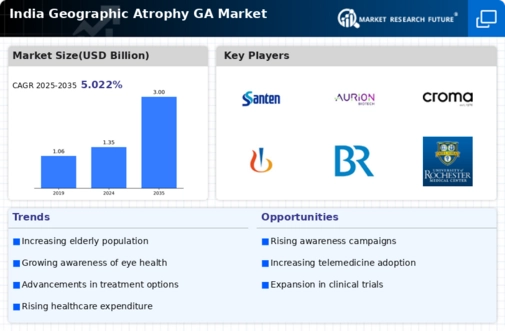

Increasing Prevalence of Geographic Atrophy

The India Geographic Atrophy Ga Market is witnessing a notable increase in the prevalence of geographic atrophy, particularly among the aging population. As per recent health surveys, the incidence of age-related macular degeneration (AMD), which includes geographic atrophy, is projected to rise significantly in the coming years. This trend is largely attributed to demographic shifts, with a growing elderly population that is more susceptible to vision-related disorders. The increasing number of patients seeking treatment is likely to drive demand for innovative therapies and management solutions within the India Geographic Atrophy Ga Market. Furthermore, the government has initiated various health programs aimed at early detection and management of eye diseases, which may further contribute to the market's growth.

Rising Investment in Research and Development

Investment in research and development (R&D) within the India Geographic Atrophy Ga Market is on the rise, driven by both public and private sectors. Pharmaceutical companies are increasingly focusing on developing novel therapies for geographic atrophy, including gene therapies and regenerative medicine approaches. The Indian government has also been promoting R&D through various funding schemes and incentives, encouraging innovation in the field of ophthalmology. This influx of investment is expected to lead to the introduction of new treatment modalities that could significantly alter the landscape of the India Geographic Atrophy Ga Market. As a result, patients may gain access to more effective and targeted therapies, improving overall outcomes.

Technological Advancements in Diagnostic Tools

The India Geographic Atrophy Ga Market is experiencing a transformation due to technological advancements in diagnostic tools. Innovations such as optical coherence tomography (OCT) and fundus photography have significantly improved the accuracy of geographic atrophy diagnosis. These technologies enable healthcare professionals to detect the condition at earlier stages, facilitating timely intervention. The integration of artificial intelligence in diagnostic processes is also emerging, potentially enhancing the efficiency and effectiveness of patient assessments. As these advanced diagnostic tools become more widely adopted in India, they are likely to increase the number of diagnosed cases, thereby expanding the market for geographic atrophy treatments. The growing emphasis on precision medicine further underscores the importance of accurate diagnostics in the India Geographic Atrophy Ga Market.