Rising Awareness and Education

Rising awareness and education regarding glioma and its treatment options are driving the glioma diagnosis-treatment market. Increased public knowledge about the symptoms and risks associated with gliomas is leading to more individuals seeking medical advice. Educational campaigns by healthcare organizations and non-profits are instrumental in disseminating information about glioma, which may contribute to earlier diagnoses. In India, the focus on health education is expected to grow, with initiatives aimed at informing the public about brain tumors. This heightened awareness is likely to result in increased demand for diagnostic services and treatment options, thereby positively impacting the glioma diagnosis-treatment market. As more patients become informed about their health, the market is poised for growth.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the glioma diagnosis-treatment market. The Indian government has been increasingly investing in healthcare infrastructure, particularly in oncology. Programs aimed at enhancing cancer care facilities and increasing access to advanced diagnostic tools are being implemented. For instance, the National Cancer Control Program aims to reduce cancer mortality rates through early detection and treatment. Such initiatives are expected to bolster the glioma diagnosis-treatment market by improving access to necessary resources and technologies. Furthermore, public-private partnerships are emerging to facilitate research and development in glioma therapies, potentially leading to innovative treatment options. This supportive environment is likely to encourage market growth and improve patient care in the long term.

Increasing Incidence of Glioma Cases

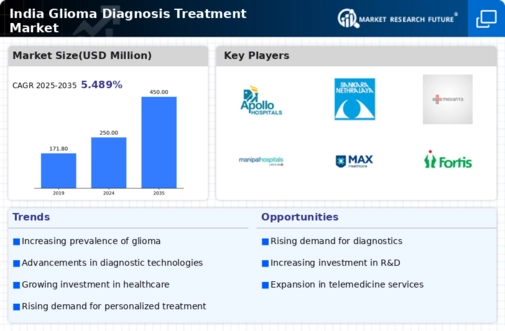

The rising incidence of glioma cases in India is a primary driver for the glioma diagnosis-treatment market. Recent statistics indicate that the annual incidence rate of gliomas in India is approximately 3.5 per 100,000 individuals. This increase in cases necessitates enhanced diagnostic and treatment options, thereby propelling market growth. As awareness of glioma symptoms improves, more patients seek medical attention, leading to earlier diagnoses and treatment interventions. The growing population and urbanization contribute to this trend, as lifestyle changes may increase the risk factors associated with gliomas. Consequently, healthcare providers are compelled to invest in advanced diagnostic technologies and treatment modalities to cater to the rising demand, which is expected to further stimulate the glioma diagnosis-treatment market in the coming years.

Emergence of Innovative Treatment Modalities

The emergence of innovative treatment modalities is reshaping the glioma diagnosis-treatment market. Recent developments in immunotherapy and targeted therapies are providing new avenues for glioma management. In India, clinical trials are increasingly exploring these novel approaches, which may offer improved efficacy compared to traditional treatments. The potential for personalized medicine, tailored to individual patient profiles, is gaining traction, suggesting a shift in treatment paradigms. As these innovative therapies become more accessible, they are likely to drive demand within the glioma diagnosis-treatment market. The ongoing research and development efforts in this area indicate a promising future for glioma patients, as new treatment options may enhance survival rates and quality of life.

Technological Advancements in Diagnostic Tools

Technological advancements in diagnostic tools are significantly influencing the glioma diagnosis-treatment market. Innovations such as MRI, CT scans, and PET scans have improved the accuracy and speed of glioma detection. The integration of artificial intelligence in imaging analysis is also emerging, potentially enhancing diagnostic precision. In India, the market for advanced imaging technologies is projected to grow at a CAGR of around 10% over the next five years. These advancements not only facilitate early detection but also aid in monitoring treatment responses, thereby improving patient outcomes. As healthcare facilities adopt these cutting-edge technologies, the glioma diagnosis-treatment market is likely to experience substantial growth, driven by the demand for more effective and efficient diagnostic solutions.