Growing Incidence of Glioma Cases

The glioma diagnosis-treatment market is experiencing growth. This growth is due to the increasing incidence of glioma cases in the US. Recent statistics indicate that gliomas account for approximately 30% of all brain tumors, with an estimated 24,000 new cases diagnosed annually. This rising prevalence necessitates enhanced diagnostic and treatment options, driving demand for advanced imaging technologies and innovative therapies. As healthcare providers seek to improve patient outcomes, the market is likely to see a surge in investments aimed at developing more effective treatment protocols. Furthermore, the aging population, which is more susceptible to gliomas, contributes to this upward trend. Consequently, the growing incidence of glioma cases is a significant driver for the glioma diagnosis-treatment market, prompting stakeholders to focus on research and development initiatives to address this pressing health concern.

Rising Investment in Cancer Research

Rising investment in cancer research is significantly impacting the glioma diagnosis-treatment market. Funding from both public and private sectors is increasingly directed towards understanding the biology of gliomas and developing new therapeutic strategies. In recent years, federal funding for cancer research has seen a substantial increase, with billions allocated to various initiatives aimed at combating brain tumors. This influx of capital is fostering collaborations between academic institutions, research organizations, and pharmaceutical companies, leading to breakthroughs in glioma treatment. As research efforts intensify, the glioma diagnosis-treatment market is poised for growth, with the potential for new therapies and diagnostic tools emerging from these investments. The focus on innovative research is likely to enhance the efficacy of glioma treatments, ultimately benefiting patients and healthcare providers.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a crucial driver in the glioma diagnosis-treatment market. The US Food and Drug Administration (FDA) has been actively facilitating the approval process for new treatments, particularly those that demonstrate significant advancements over existing therapies. This supportive regulatory environment encourages pharmaceutical companies to invest in research and development, leading to the introduction of novel treatment options for glioma patients. The expedited approval pathways for breakthrough therapies and orphan drugs are particularly beneficial for addressing the unmet needs in glioma treatment. As a result, the glioma diagnosis-treatment market is likely to see an influx of innovative therapies that could improve patient outcomes and survival rates, thereby enhancing the overall landscape of glioma care.

Increased Awareness and Education Initiatives

Increased awareness and education initiatives regarding gliomas are contributing to the growth of the glioma diagnosis-treatment market. Campaigns aimed at educating the public about the symptoms and risks associated with gliomas are leading to earlier diagnoses and improved treatment outcomes. Organizations and healthcare providers are actively engaging in outreach programs, which have resulted in a notable increase in patient consultations. This heightened awareness is reflected in the rising demand for diagnostic services and treatment options, as patients are more informed about their health. Furthermore, educational initiatives targeting healthcare professionals are enhancing their ability to recognize and manage glioma cases effectively. As a result, the glioma diagnosis-treatment market is likely to benefit from this trend, as more individuals seek timely medical intervention and innovative treatment solutions.

Technological Innovations in Treatment Modalities

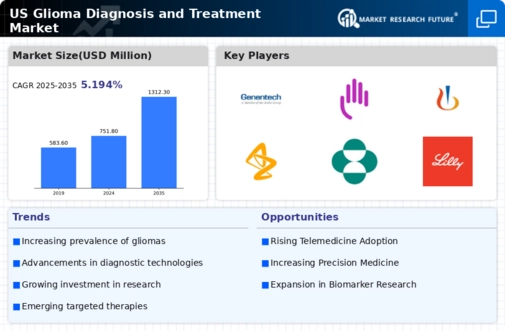

Technological advancements are playing a pivotal role in shaping the glioma diagnosis-treatment market. Innovations such as intraoperative imaging, robotic-assisted surgeries, and novel drug delivery systems are enhancing the precision and effectiveness of glioma treatments. For instance, the introduction of targeted therapies and immunotherapies has shown promising results in clinical trials, potentially improving survival rates for patients. The market is projected to witness a compound annual growth rate (CAGR) of around 7% over the next five years, driven by these technological innovations. Additionally, the integration of artificial intelligence in diagnostic imaging is streamlining the identification of gliomas, allowing for earlier and more accurate diagnoses. As these technologies continue to evolve, they are expected to significantly impact the glioma diagnosis-treatment market, offering new hope for patients and healthcare providers alike.