Advancements in GPU Technology

Technological advancements in GPU architecture and processing capabilities are driving the growth of the India GPU database market. The introduction of more powerful GPUs with enhanced parallel processing capabilities allows for faster data retrieval and processing. This is particularly beneficial for applications requiring real-time analytics and complex computations. As companies seek to leverage these advancements, the adoption of GPU databases is likely to increase. Furthermore, the continuous innovation in GPU technology, including the development of specialized hardware for database management, is expected to create new opportunities within the market, fostering further growth.

Surge in Big Data Applications

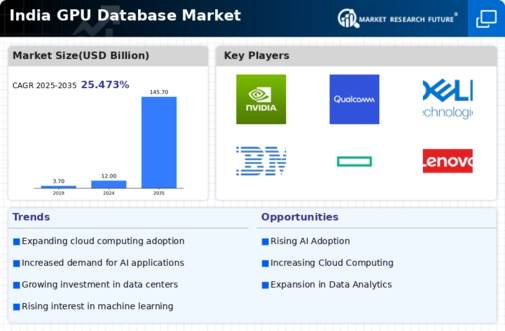

The proliferation of big data applications across various industries in India is a significant catalyst for the India GPU database market. As organizations generate and collect vast amounts of data, the need for efficient storage and processing solutions becomes paramount. GPU databases offer the capability to handle large datasets with high performance, making them an attractive option for businesses. Industries such as finance, healthcare, and retail are increasingly adopting big data analytics to enhance customer experiences and optimize operations. The big data market in India is projected to grow at a CAGR of 26.5% from 2020 to 2025, indicating a strong demand for GPU-accelerated database solutions.

Increased Focus on Cybersecurity

The heightened focus on cybersecurity in India is emerging as a crucial driver for the India GPU database market. As data breaches and cyber threats become more prevalent, organizations are prioritizing the security of their data assets. GPU databases, with their ability to process and analyze data in real-time, can enhance security measures by enabling faster detection of anomalies and potential threats. The Indian government has also implemented various policies to strengthen cybersecurity frameworks, which may further encourage the adoption of advanced database technologies. As businesses invest in robust security solutions, the demand for GPU-accelerated databases is likely to rise, contributing to market growth.

Growing Demand for Data Analytics

The increasing reliance on data analytics across various sectors in India is a primary driver for the India GPU database market. Organizations are leveraging data to gain insights, enhance decision-making, and improve operational efficiency. According to recent reports, the data analytics market in India is projected to reach USD 16 billion by 2025, indicating a robust growth trajectory. This surge in demand for data-driven solutions necessitates advanced database technologies, particularly those utilizing GPU acceleration. As businesses seek to process large volumes of data swiftly, the adoption of GPU databases is likely to rise, thereby propelling the market forward.

Expansion of Cloud Computing Services

The rapid expansion of cloud computing services in India is significantly influencing the India GPU database market. With major cloud service providers establishing data centers in the country, there is an increasing availability of GPU-accelerated database solutions. This trend is supported by the Indian government's initiatives to promote digital infrastructure, which has led to a rise in cloud adoption among enterprises. As organizations migrate to the cloud, the demand for efficient data management solutions, including GPU databases, is expected to grow. The cloud computing market in India is anticipated to reach USD 7.1 billion by 2025, further driving the need for advanced database technologies.