Advancements in GPU Technology

Technological advancements in GPU architecture and processing power are propelling the US Gpu Database Market forward. The introduction of more powerful GPUs, such as NVIDIA's A100 and AMD's MI100, has enabled organizations to handle complex queries and large datasets more efficiently. These innovations allow for faster data retrieval and processing, which is essential for applications in sectors like autonomous vehicles and smart cities. As the capabilities of GPUs expand, the market is likely to witness increased investment from companies looking to leverage these technologies for competitive advantage. This trend suggests a robust future for the US Gpu Database Market as it adapts to the evolving technological landscape.

Growing Demand for Real-Time Analytics

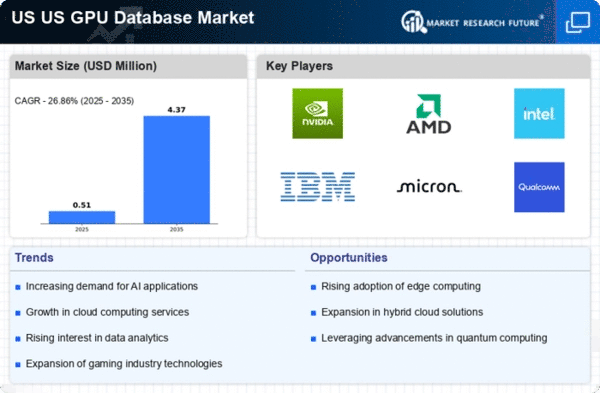

The US Gpu Database Market is experiencing a surge in demand for real-time analytics, driven by the need for businesses to make data-driven decisions swiftly. Organizations across various sectors, including finance, healthcare, and retail, are increasingly relying on GPU databases to process large volumes of data in real-time. This trend is underscored by the fact that The Gpu Database is projected to reach USD 274 billion by 2022, with a significant portion attributed to real-time processing capabilities. As companies seek to enhance operational efficiency and customer experience, the adoption of GPU databases is likely to continue growing, positioning the US Gpu Database Market as a critical player in the analytics landscape.

Rising Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the US Gpu Database Market. Many organizations are migrating their data storage and processing to cloud platforms to benefit from scalability, flexibility, and cost-effectiveness. According to recent data, the cloud computing market in the US is expected to grow to USD 832 billion by 2025, with a substantial portion driven by GPU database services. This transition allows businesses to access powerful GPU resources without the need for substantial upfront investments in hardware. As cloud adoption continues to rise, the US Gpu Database Market is poised to expand, catering to the needs of organizations seeking efficient data management solutions.

Regulatory Compliance and Data Security Needs

The increasing regulatory compliance requirements and data security concerns are driving the US Gpu Database Market. Organizations are mandated to adhere to various regulations, such as GDPR and HIPAA, which necessitate robust data management solutions. GPU databases offer enhanced security features and performance, making them an attractive option for businesses handling sensitive information. As data breaches become more prevalent, the emphasis on secure data storage and processing is likely to grow. This trend suggests that the US Gpu Database Market will play a crucial role in helping organizations meet compliance standards while ensuring data integrity and security.

Increased Focus on Data-Driven Decision Making

In the current business environment, there is an increased focus on data-driven decision making, which is significantly impacting the US Gpu Database Market. Companies are recognizing the value of leveraging data analytics to gain insights and improve operational efficiency. This trend is reflected in the growing investment in data infrastructure, with the US data management market projected to reach USD 122 billion by 2025. As organizations strive to harness the power of their data, the demand for GPU databases, which facilitate faster data processing and analysis, is likely to rise. This shift underscores the importance of the US Gpu Database Market in supporting businesses' analytical capabilities.