Growth of Health Insurance Coverage

The expansion of health insurance coverage in India is significantly impacting the healthcare revenue-cycle-management market. With the government's initiatives to increase insurance penetration, more individuals are gaining access to healthcare services. This shift necessitates robust revenue-cycle-management solutions to handle the complexities of insurance claims processing. As of 2025, it is estimated that health insurance coverage in India has reached approximately 50% of the population, creating a substantial increase in claim submissions. This growth presents both challenges and opportunities for healthcare providers, as they must adapt their revenue-cycle-management strategies to effectively manage the influx of insurance claims and ensure timely reimbursements.

Technological Advancements in Healthcare IT

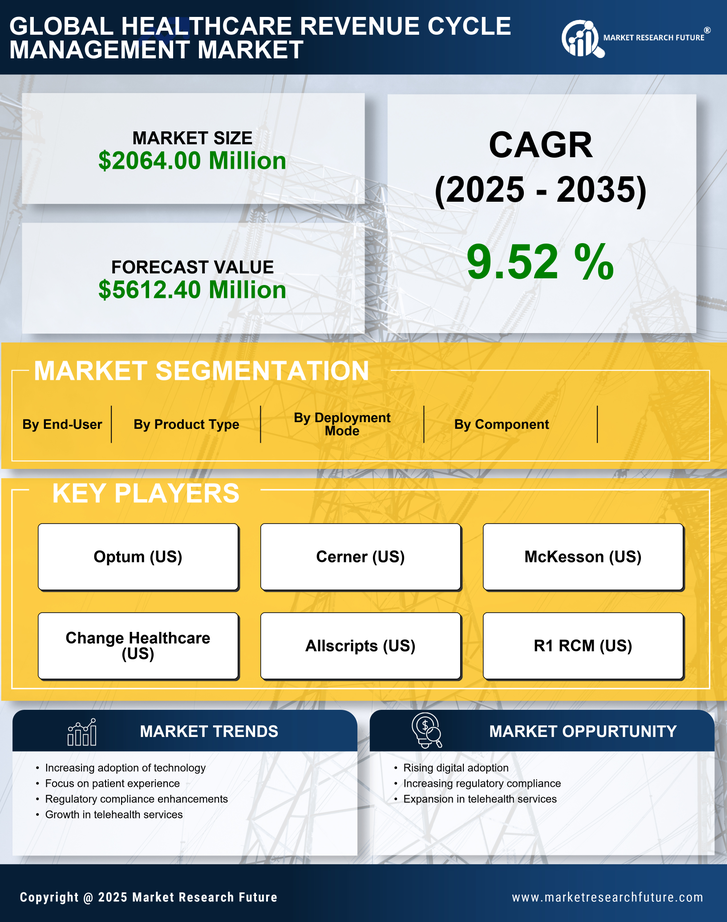

Technological advancements in healthcare IT are reshaping the landscape of the healthcare revenue-cycle-management market in India. The integration of artificial intelligence (AI) and machine learning (ML) into revenue-cycle processes is enhancing efficiency and accuracy. These technologies enable predictive analytics, which can identify potential billing issues before they arise, thus reducing the risk of revenue loss. As of November 2025, it is projected that the adoption of AI-driven solutions in revenue-cycle management could lead to a reduction in operational costs by up to 30%. This trend indicates a shift towards more sophisticated revenue-cycle-management systems that leverage technology to optimize financial performance.

Focus on Patient Experience and Satisfaction

The emphasis on patient experience and satisfaction is becoming a critical driver for the healthcare revenue-cycle-management market in India. Healthcare providers are increasingly recognizing that a positive patient experience can lead to improved financial outcomes. As patients become more informed and engaged, they expect transparency in billing and payment processes. This shift is prompting healthcare organizations to adopt revenue-cycle-management solutions that prioritize patient communication and ease of payment. By enhancing the patient experience, providers can potentially increase patient retention and loyalty, which are essential for sustaining revenue streams in a competitive market.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements are exerting a significant influence on the healthcare revenue-cycle-management market in India. As the government continues to implement new healthcare policies and regulations, healthcare providers must adapt their revenue-cycle processes to remain compliant. This includes adhering to updated billing codes and reporting standards. Non-compliance can result in substantial financial penalties, making it imperative for organizations to invest in robust revenue-cycle-management systems that ensure adherence to regulatory standards. As of November 2025, it is estimated that compliance-related costs could account for up to 15% of total operational expenses for healthcare providers, underscoring the importance of effective revenue-cycle management.

Increasing Demand for Efficient Billing Solutions

The healthcare revenue-cycle-management market in India is experiencing a surge in demand for efficient billing solutions. As healthcare providers strive to enhance their financial performance, the need for streamlined billing processes becomes paramount. This demand is driven by the rising complexity of healthcare services and the necessity for accurate billing to minimize revenue leakage. According to recent data, hospitals in India have reported an increase in billing errors, leading to potential revenue losses of up to 20%. Consequently, healthcare organizations are investing in advanced revenue-cycle-management systems to ensure timely and accurate billing, thereby improving cash flow and overall financial health.