Government Initiatives and Support

Government initiatives play a crucial role in shaping the India indoor positioning navigation system market. The Indian government has been actively promoting smart city projects, which include the implementation of advanced navigation systems in urban areas. Policies aimed at enhancing digital infrastructure, such as the Digital India initiative, are likely to bolster the adoption of indoor positioning technologies. As of January 2026, several states have begun pilot projects to integrate indoor navigation systems in public transport hubs and shopping complexes. This governmental support not only provides funding but also encourages public-private partnerships, fostering innovation in the sector. The establishment of regulatory frameworks further ensures the standardization and safety of these technologies, thereby enhancing consumer trust and market growth.

Integration with Smart Technologies

The integration of indoor positioning navigation systems with smart technologies is emerging as a pivotal driver for the India indoor positioning navigation system market. The convergence of indoor navigation with smart building technologies, such as energy management systems and automated lighting, is likely to enhance operational efficiencies. As of January 2026, the market is expected to see a significant uptick in demand for solutions that offer seamless connectivity between indoor positioning systems and smart devices. This integration not only improves user experiences but also contributes to sustainability efforts by optimizing resource usage. Furthermore, the rise of smart homes and offices in India is anticipated to create new opportunities for indoor positioning technologies, as consumers increasingly seek interconnected solutions that enhance convenience and functionality.

Increased Focus on Safety and Security

The heightened focus on safety and security in public spaces is a significant driver for the India indoor positioning navigation system market. As urbanization accelerates, the need for effective crowd management and emergency response systems becomes paramount. Indoor positioning technologies can facilitate real-time tracking of individuals in large venues such as malls, airports, and stadiums, thereby enhancing safety protocols. As of January 2026, the market is witnessing a surge in demand for solutions that integrate indoor navigation with security systems, enabling swift responses to emergencies. This trend is particularly relevant in the context of large public gatherings, where ensuring safety is a top priority. Consequently, businesses and government entities are increasingly investing in these technologies to bolster security measures, thereby driving market growth.

Rising Demand in Retail and Healthcare Sectors

The increasing demand for indoor positioning navigation systems in the retail and healthcare sectors significantly drives the India indoor positioning navigation system market. Retailers are leveraging these systems to enhance customer engagement by providing personalized shopping experiences and efficient store navigation. As of January 2026, the retail sector is expected to account for over 40% of the market share, driven by the need for improved customer service and operational efficiency. In healthcare, indoor navigation systems are being utilized to streamline patient flow and improve emergency response times in hospitals. The growing emphasis on patient-centric care is likely to propel the adoption of these technologies, making them indispensable in modern healthcare facilities. This dual demand from retail and healthcare sectors is expected to sustain robust growth in the market.

Technological Advancements in Indoor Positioning

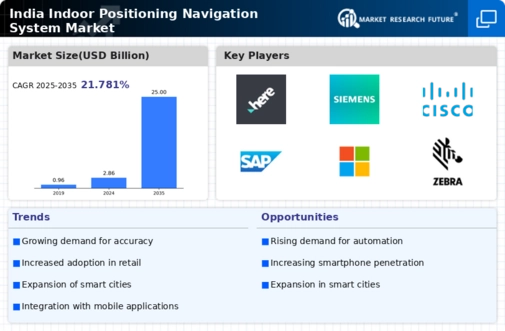

The rapid evolution of technology is a primary driver for the India indoor positioning navigation system market. Innovations in Bluetooth Low Energy (BLE), Wi-Fi, and Ultra-Wideband (UWB) technologies have enhanced the accuracy and reliability of indoor navigation systems. As of January 2026, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 30% over the next five years. This growth is fueled by the increasing integration of artificial intelligence and machine learning, which optimize location-based services. Furthermore, the proliferation of smartphones and IoT devices in India has created a conducive environment for the adoption of advanced indoor positioning systems. Consequently, businesses are increasingly investing in these technologies to improve customer experiences and operational efficiencies.