Government Initiatives and Support

Government initiatives aimed at promoting smart infrastructure and digital transformation are significantly influencing the japan indoor positioning navigation system market. The Japanese government has been actively investing in technology development and infrastructure improvements, particularly in urban areas. Policies encouraging the adoption of advanced technologies, such as the 'Society 5.0' initiative, aim to integrate digital solutions into everyday life. This initiative emphasizes the importance of data utilization and connectivity, which directly supports the growth of indoor positioning systems. Furthermore, public-private partnerships are emerging to facilitate the deployment of these technologies in public spaces, enhancing accessibility and safety. As a result, the market is likely to witness increased funding and resources dedicated to the development of innovative indoor navigation solutions.

Growth of E-Commerce and Retail Sector

The rapid expansion of the e-commerce and retail sector in Japan is driving the demand for indoor positioning navigation systems. With the rise of online shopping, brick-and-mortar stores are increasingly adopting technology to enhance the in-store experience. The japan indoor positioning navigation system market is witnessing a surge in demand as retailers seek to provide personalized shopping experiences through location-based services. For instance, retailers are utilizing indoor navigation to guide customers to specific products, thereby improving customer satisfaction and increasing sales. Recent statistics indicate that the retail sector in Japan is expected to grow by approximately 5% annually, further fueling the need for effective indoor navigation solutions. This trend suggests that retailers are recognizing the value of integrating advanced navigation systems to remain competitive in a rapidly evolving market.

Increased Focus on Safety and Security

The heightened focus on safety and security in public spaces is driving the growth of the japan indoor positioning navigation system market. In light of recent events, there is a growing emphasis on ensuring the safety of individuals in crowded environments such as airports, shopping centers, and public transport hubs. Indoor positioning systems play a vital role in enhancing safety by providing real-time location data, enabling efficient crowd management and emergency response. For instance, during emergencies, these systems can assist in guiding individuals to safety and providing critical information to first responders. As a result, organizations are increasingly investing in indoor navigation solutions to bolster safety measures. This trend indicates a potential for significant market growth as stakeholders prioritize the implementation of advanced navigation systems to enhance security in various indoor environments.

Rising Demand for Location-Based Services

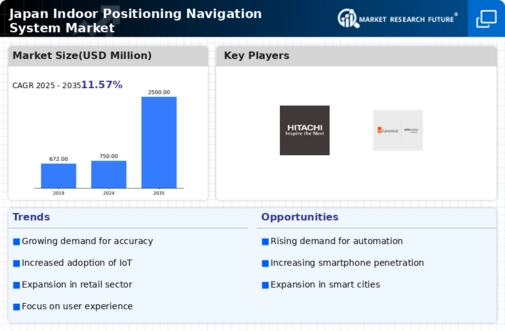

The increasing demand for location-based services in Japan is a primary driver for the japan indoor positioning navigation system market. As urbanization accelerates, businesses and consumers alike seek efficient navigation solutions within complex indoor environments such as shopping malls, airports, and hospitals. According to recent data, the market for location-based services in Japan is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is fueled by the proliferation of smartphones and mobile applications that leverage indoor positioning technologies, enhancing user experiences and operational efficiencies. Consequently, businesses are investing in indoor navigation systems to improve customer engagement and streamline operations, thereby propelling the overall market forward.

Technological Advancements in Indoor Positioning

Technological advancements in indoor positioning technologies are a crucial driver for the japan indoor positioning navigation system market. Innovations such as Bluetooth Low Energy (BLE), Wi-Fi RTT, and ultra-wideband (UWB) are enhancing the accuracy and reliability of indoor navigation systems. These technologies enable precise location tracking, which is essential for applications in various sectors, including healthcare, logistics, and entertainment. As organizations increasingly recognize the benefits of these advancements, investments in indoor positioning systems are expected to rise. The integration of artificial intelligence and machine learning into these systems is also anticipated to improve user experiences by providing real-time data and analytics. Consequently, the market is likely to experience robust growth as businesses adopt these cutting-edge technologies to optimize their operations and enhance customer engagement.