Rising Demand for Automation

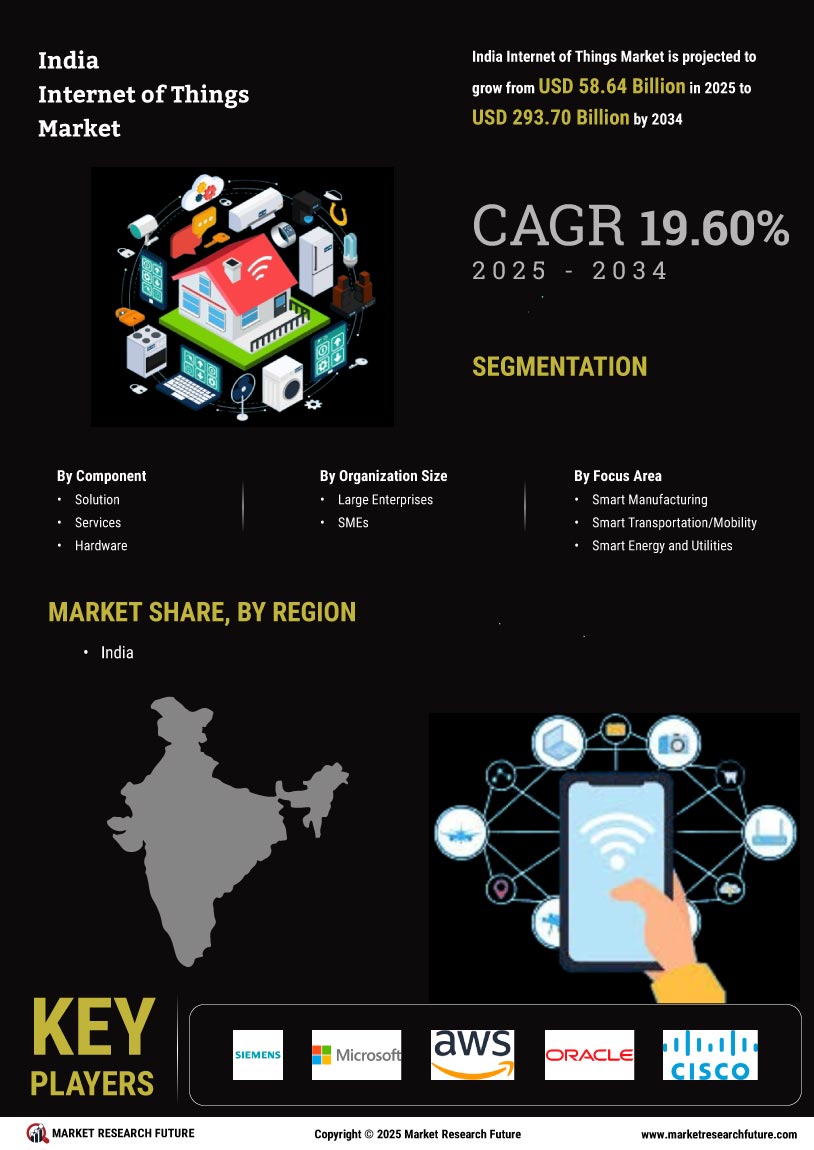

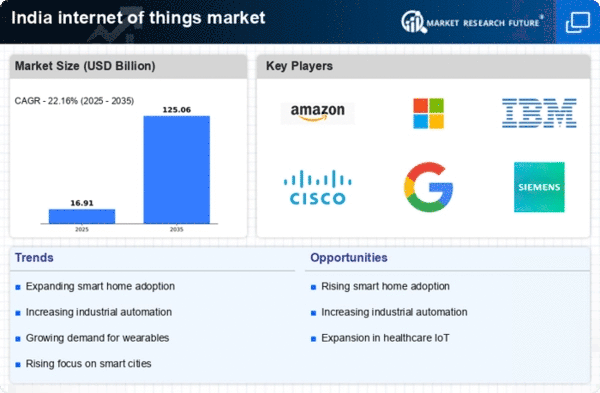

The India Internet of Things Market is experiencing a notable surge in demand for automation across various sectors. Industries such as manufacturing, agriculture, and healthcare are increasingly adopting IoT solutions to enhance operational efficiency and reduce costs. For instance, the manufacturing sector is projected to witness a growth rate of approximately 30% in IoT adoption by 2025, driven by the need for smart factories and predictive maintenance. This trend indicates a shift towards more automated processes, where IoT devices play a crucial role in monitoring and controlling operations in real-time. As businesses recognize the potential of IoT to streamline workflows and improve productivity, the demand for automation solutions is likely to continue its upward trajectory, further propelling the growth of the India Internet of Things Market.

Expansion of 5G Infrastructure

The rollout of 5G technology is poised to significantly impact the India Internet of Things Market. With its high-speed connectivity and low latency, 5G is expected to facilitate the deployment of IoT devices across various applications, including smart cities, autonomous vehicles, and industrial automation. The Indian government has been actively promoting the development of 5G infrastructure, which is anticipated to enhance the connectivity of IoT devices. By 2025, it is estimated that the number of connected devices in India could reach over 1 billion, largely fueled by the capabilities of 5G networks. This expansion not only supports the growth of IoT applications but also encourages innovation in sectors such as healthcare and transportation, thereby driving the overall market forward.

Increased Focus on Data Analytics

Data analytics is becoming a cornerstone of the India Internet of Things Market, as organizations seek to derive actionable insights from the vast amounts of data generated by IoT devices. The integration of advanced analytics tools with IoT systems enables businesses to monitor performance, predict trends, and make informed decisions. It is estimated that the analytics segment within the IoT market could grow at a compound annual growth rate of over 25% by 2025. This growth is driven by the need for real-time data processing and the ability to harness big data for strategic advantage. As companies increasingly recognize the value of data-driven decision-making, the demand for IoT solutions that incorporate robust analytics capabilities is likely to rise, further propelling the India Internet of Things Market.

Emergence of Smart Consumer Devices

The proliferation of smart consumer devices is significantly influencing the India Internet of Things Market. With the increasing adoption of smart home technologies, such as connected appliances, security systems, and energy management solutions, consumers are becoming more engaged with IoT applications. The market for smart home devices in India is projected to grow at a rate of approximately 20% annually, reflecting a shift in consumer preferences towards convenience and efficiency. This trend is further supported by the rising penetration of smartphones and internet connectivity, which facilitate the control and monitoring of smart devices. As consumer awareness and demand for smart technologies continue to rise, the India Internet of Things Market is likely to experience substantial growth, driven by innovations in consumer electronics and home automation.

Government Initiatives and Policies

The India Internet of Things Market is benefiting from various government initiatives aimed at promoting digital transformation and technological advancement. Programs such as Digital India and Smart Cities Mission are designed to foster the adoption of IoT technologies across urban and rural landscapes. The government has allocated substantial funding to support research and development in IoT, which is expected to enhance the ecosystem for startups and established companies alike. Furthermore, regulatory frameworks are being established to ensure data security and privacy, which are critical for the widespread acceptance of IoT solutions. As these initiatives gain momentum, they are likely to create a conducive environment for the growth of the India Internet of Things Market, attracting investments and encouraging innovation.