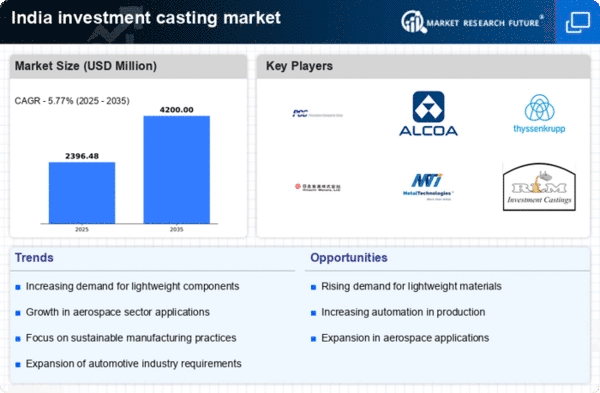

The investment casting market in India is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand across various sectors, including aerospace, automotive, and industrial applications. Major players such as Precision Castparts Corp (US), Alcoa Corporation (US), and Thyssenkrupp AG (DE) are strategically positioned to leverage innovation and operational efficiency. Precision Castparts Corp (US) focuses on enhancing its manufacturing capabilities through advanced materials and processes, while Alcoa Corporation (US) emphasizes sustainability in its operations, aiming to reduce carbon emissions and improve resource efficiency. Thyssenkrupp AG (DE) is actively pursuing digital transformation initiatives to optimize its production processes, thereby shaping a competitive environment that prioritizes technological integration and sustainability.Key business tactics within the market include localizing manufacturing to reduce costs and enhance supply chain resilience. The competitive structure appears moderately fragmented, with several players vying for market share. However, the collective influence of key players is significant, as they drive innovation and set industry standards. This competitive dynamic encourages smaller firms to adopt advanced technologies and improve their operational efficiencies to remain relevant.

In October Alcoa Corporation (US) announced a partnership with a leading Indian automotive manufacturer to develop lightweight, high-strength components using advanced investment casting techniques. This collaboration is strategically important as it not only enhances Alcoa's market presence in India but also aligns with the growing demand for lightweight materials in the automotive sector, potentially leading to increased sales and market share.

In September Thyssenkrupp AG (DE) launched a new digital platform aimed at streamlining its investment casting operations. This initiative is likely to improve production efficiency and reduce lead times, thereby enhancing customer satisfaction. The strategic importance of this move lies in its potential to position Thyssenkrupp as a leader in digital manufacturing within the investment casting market, setting a benchmark for competitors.

In August Precision Castparts Corp (US) expanded its manufacturing facility in India, focusing on aerospace components. This expansion is indicative of the company's commitment to meeting the rising demand for aerospace parts in the region. The strategic significance of this development is profound, as it not only increases production capacity but also reinforces Precision Castparts' position as a key supplier in the aerospace sector.

As of November current trends in the investment casting market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing operational efficiencies. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices, indicating a shift towards a more sophisticated competitive environment.