Growing Smartphone Adoption

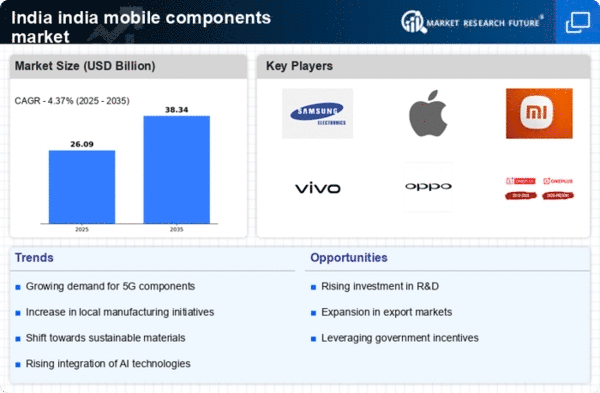

The India Mobile Components Market is experiencing a surge in demand due to the increasing adoption of smartphones across the country. As of January 2026, India boasts over 1.2 billion mobile subscribers, with smartphone penetration reaching approximately 50 percent. This trend is likely to continue, driven by the rising affordability of devices and the proliferation of 4G and 5G networks. The growing reliance on mobile technology for communication, entertainment, and business is propelling the demand for mobile components such as batteries, displays, and processors. Furthermore, the Indian government's initiatives to promote digital literacy and connectivity are expected to further stimulate market growth, creating opportunities for local manufacturers and suppliers in the mobile components sector.

Rising Demand for 5G Technology

The rollout of 5G technology in India is poised to be a game-changer for the mobile components sector. As of January 2026, telecom operators are actively expanding their 5G networks, which is expected to drive demand for advanced mobile components that support higher data speeds and improved connectivity. The India Mobile Components Market is likely to witness increased requirements for components such as antennas, chipsets, and RF modules that are compatible with 5G technology. This transition to 5G is anticipated to not only enhance user experience but also open new avenues for applications in sectors like IoT, smart cities, and autonomous vehicles, thereby creating a ripple effect on the demand for mobile components.

Emergence of E-commerce Platforms

The rise of e-commerce platforms in India is significantly influencing the distribution channels for mobile components. As of January 2026, online sales of mobile components have surged, providing manufacturers with a direct channel to reach consumers and businesses. The India Mobile Components Market is benefiting from this trend, as e-commerce platforms facilitate easier access to a wider range of products, including spare parts and accessories. This shift towards online retail is not only enhancing market reach but also enabling competitive pricing and improved customer service. Additionally, the growing trend of DIY repairs among consumers is likely to further boost the demand for mobile components sold through e-commerce channels.

Government Initiatives and Policies

The Indian government has implemented various initiatives aimed at boosting the domestic manufacturing of mobile components, which is a crucial driver for the India Mobile Components Market. Programs such as 'Make in India' and the Production-Linked Incentive (PLI) scheme are designed to attract investments and enhance local production capabilities. As of January 2026, the PLI scheme has already attracted significant investments from global players, leading to the establishment of manufacturing units in India. This policy framework not only aims to reduce dependency on imports but also encourages innovation and skill development within the country. The government's focus on creating a robust ecosystem for mobile component manufacturing is likely to enhance the competitiveness of Indian firms in the global market.

Consumer Preference for Quality and Durability

As consumers in India become more discerning, there is a noticeable shift towards quality and durability in mobile components. The India Mobile Components Market is responding to this trend by focusing on the production of high-quality components that can withstand the rigors of daily use. This shift is evident in the increasing demand for premium materials and advanced manufacturing techniques that enhance the longevity of mobile devices. Manufacturers are investing in research and development to innovate and improve the performance of components such as batteries and screens. This consumer preference for quality is likely to drive competition among manufacturers, pushing them to adopt better practices and technologies to meet evolving market expectations.