Market Growth Projections

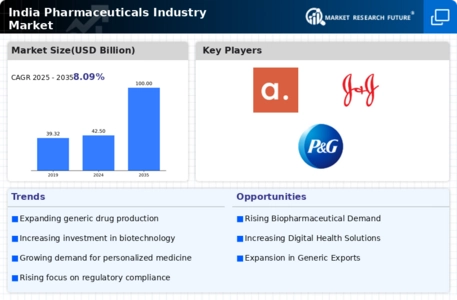

The Global India Pharmaceuticals Industry Market is projected to experience substantial growth, with forecasts indicating a market size of 42.5 USD Billion in 2024 and a potential reach of 100 USD Billion by 2035. The anticipated compound annual growth rate of 8.09% from 2025 to 2035 underscores the market's resilience and adaptability. This growth trajectory reflects the increasing demand for pharmaceuticals, driven by factors such as population growth, rising healthcare expenditures, and advancements in medical technology. The market's expansion is indicative of India's strategic importance in the global pharmaceutical landscape.

Rising Export Opportunities

Rising export opportunities are significantly contributing to the Global India Pharmaceuticals Industry Market. India is recognized as a leading exporter of pharmaceuticals, supplying to over 200 countries. The increasing global demand for affordable medications, particularly in emerging markets, is likely to bolster India's export capabilities. The market's growth is further supported by favorable trade agreements and collaborations with international organizations. As the global healthcare landscape evolves, India's pharmaceutical exports are expected to expand, enhancing the market's overall value and positioning India as a key player in the global pharmaceutical supply chain.

Advancements in Biotechnology

Advancements in biotechnology are significantly influencing the Global India Pharmaceuticals Industry Market. The integration of biopharmaceuticals, which are derived from biological sources, is expanding the treatment landscape for various diseases. The market is expected to evolve with innovative therapies that address unmet medical needs, potentially leading to a market size of 100 USD Billion by 2035. The Indian biotechnology sector is increasingly collaborating with global firms, fostering research and development that enhances the efficacy and safety of new drugs, thereby driving market growth.

Growing Demand for Generic Drugs

The Global India Pharmaceuticals Industry Market is witnessing a robust demand for generic drugs, primarily due to their affordability and accessibility. With the Indian government promoting the use of generics, the market is projected to reach 42.5 USD Billion in 2024. This shift towards generics is driven by rising healthcare costs globally, compelling patients and healthcare providers to seek cost-effective alternatives. Furthermore, the increasing prevalence of chronic diseases necessitates a broader range of affordable medication options, thereby enhancing the market's growth potential.

Government Initiatives and Policies

Government initiatives and policies play a crucial role in shaping the Global India Pharmaceuticals Industry Market. The Indian government has implemented various schemes aimed at boosting domestic manufacturing and reducing dependency on imports. Initiatives such as the Production Linked Incentive scheme encourage pharmaceutical companies to enhance production capabilities. These policies are likely to create a conducive environment for growth, with the market projected to grow at a CAGR of 8.09% from 2025 to 2035. Such supportive measures are essential for positioning India as a global hub for pharmaceuticals.

Increasing Investment in Research and Development

Investment in research and development is a key driver for the Global India Pharmaceuticals Industry Market. Pharmaceutical companies are increasingly allocating resources to develop innovative drugs and therapies, which is vital for maintaining competitive advantage. The focus on R&D is expected to yield breakthroughs in drug development, enhancing the overall market landscape. As companies strive to meet global health challenges, the emphasis on R&D could contribute to the market's growth trajectory, potentially reaching 100 USD Billion by 2035. This investment not only fosters innovation but also strengthens India's position in the global pharmaceutical arena.