India Recovered Carbon Black Market Summary

As per Market Research Future analysis, the India Recovered Carbon Black Market Size was estimated at USD 16,699 Million in 2024. The India Recovered Carbon Black Market industry is projected to grow from USD 18,989 Million in 2025 to 72,561 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 11.8% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

India Recovered Carbon Black Market is continues to evolve rapidly, building on prior trends like regulatory pushes and tech upgrades.

- Budget 2026 proposed 50% subsidy on pyrolysis tech imports. EPR phased to 30% recycled content in tires by FY28. Biochar co-product incentives spurred dual-output plants.

- Exports doubled to Southeast Asia and Europe, fueled by REACH compliance. India's virgin carbon black capacity rise by FY27 indirectly supported rCB via integrated recycling.

- Clusters in Mundra and Dahej hosted R&D, yielding high-surface-area rCB variants. Collaborations with IITs advanced nano-enhanced grades for EVs.

- B2B demand prioritized ISCC-certified rCB, with 80% buyers mandating it by 2026. Branding as "green black" gained traction in tire marketing.

- Oil price fluctuations posed virgin substitution threats; hedging via futures stabilized supplies. R&D investments of USD 50 million countered quality gaps.

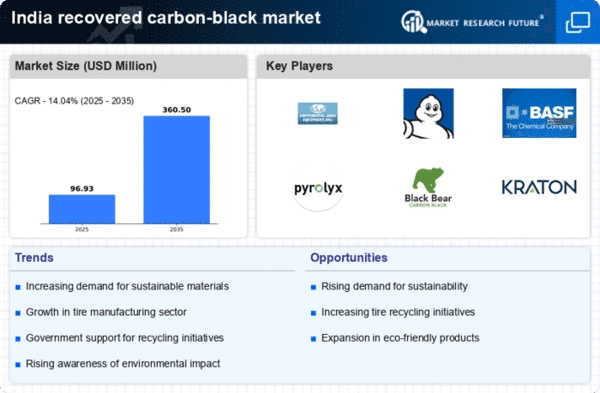

Market Size & Forecast

| 2024 Market Size | 18,989 (USD Million) |

| 2035 Market Size | 72,561 (USD Million) |

| CAGR (2025 - 2035) | 11.8% |

Major Players

Hi-Green Carbon Ltd, Finster Carbon, Capital Carbon, Epsilon Carbon Private Limited, RichTech Green Energy, Jisha Export, Absolute Green Polymers Private Limited, GoGreen Enterprises.