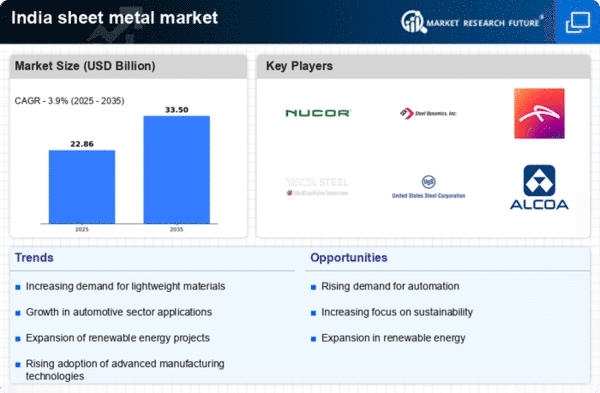

The sheet metal market in India is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Tata Steel Limited (IN), ArcelorMittal (LU), and JFE Holdings Inc (JP) are actively pursuing strategies that emphasize technological advancement and operational efficiency. Tata Steel Limited (IN) has been focusing on enhancing its production capabilities through digital transformation initiatives, which aim to optimize manufacturing processes and reduce waste. Meanwhile, ArcelorMittal (LU) is leveraging its The sheet metal market share in India, indicating a strategic focus on regional growth and supply chain optimization. JFE Holdings Inc (JP) appears to be concentrating on sustainability, integrating eco-friendly practices into its operations, which may enhance its competitive positioning in a market increasingly driven by environmental considerations.The business tactics employed by these companies reflect a moderately fragmented market structure, where local manufacturing and supply chain optimization are pivotal. The collective influence of these key players suggests a dynamic interplay of competition, with each company striving to carve out a niche through localized strategies and technological investments. This competitive environment is further complicated by the need for agility in responding to market demands and regulatory changes, which necessitates a robust operational framework.

In October Tata Steel Limited (IN) announced a significant investment in a new manufacturing facility aimed at increasing its production capacity by 20%. This strategic move is likely to bolster its market position by enhancing its ability to meet rising demand for sheet metal products in various sectors, including automotive and construction. The investment underscores Tata Steel's commitment to maintaining a competitive edge through capacity expansion and technological upgrades.

In September ArcelorMittal (LU) entered into a joint venture with a local Indian firm to develop advanced steel solutions tailored for the Indian market. This collaboration is expected to facilitate knowledge transfer and innovation, allowing ArcelorMittal to leverage local expertise while expanding its product offerings. Such strategic alliances may prove crucial in navigating the complexities of the Indian market, where localized solutions are increasingly favored.

In August JFE Holdings Inc (JP) launched a new line of eco-friendly sheet metal products designed to meet stringent environmental regulations. This initiative not only aligns with global sustainability trends but also positions JFE as a leader in the green manufacturing space. The introduction of these products may attract environmentally conscious consumers and businesses, thereby enhancing JFE's competitive differentiation in the market.

As of November the competitive trends in the sheet metal market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI) into manufacturing processes. Strategic alliances are playing a pivotal role in shaping the landscape, enabling companies to pool resources and expertise to drive innovation. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices. This shift may redefine the parameters of competition, compelling companies to innovate continuously to maintain their market positions.