Growth of Remote Work Culture

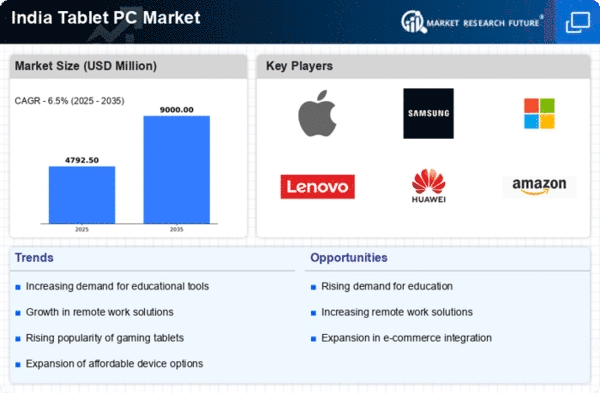

The tablet pc market in India is witnessing growth driven by the expanding remote work culture. With more companies adopting flexible work arrangements, professionals increasingly rely on portable devices for productivity. As of November 2025, around 40% of the workforce engages in remote work, creating a demand for versatile devices that can handle various tasks. Tablets, with their lightweight design and robust applications, are becoming essential tools for remote employees. This shift in work dynamics is likely to propel the tablet pc market, as businesses and individuals seek efficient solutions to maintain productivity outside traditional office environments.

Expansion of E-Commerce Platforms

The expansion of e-commerce platforms is playing a crucial role in the growth of the tablet pc market in India. With the rise of online shopping, consumers have greater access to a variety of tablet options, often at competitive prices. As of November 2025, e-commerce sales of tablets have increased by 30% compared to the previous year, indicating a shift in consumer purchasing behavior. This trend is likely to continue as more people prefer the convenience of online shopping. The tablet pc market stands to gain from this expansion, as e-commerce platforms provide a wider reach and facilitate easier access to technology for consumers across the country.

Increased Affordability of Devices

The tablet pc market in India is benefiting from the increased affordability of devices. With the entry of various brands offering budget-friendly options, consumers are more inclined to purchase tablets. As of November 2025, the average price of entry-level tablets has decreased by approximately 20%, making them accessible to a larger segment of the population. This trend is particularly evident in tier-2 and tier-3 cities, where demand for affordable technology is rising. The tablet pc market is likely to see a significant boost as more individuals and families invest in tablets for educational and entertainment purposes.

Rising Adoption of Digital Learning

The tablet pc market in India experiences a notable surge due to the increasing adoption of digital learning solutions. Educational institutions are integrating technology into their curricula, leading to a heightened demand for devices that facilitate online learning. As of 2025, approximately 60% of schools in urban areas have adopted digital tools, which significantly boosts the tablet pc market. This trend is further supported by government initiatives aimed at enhancing digital literacy among students. The tablet pc market is thus positioned to benefit from this educational transformation, as students and educators seek portable, user-friendly devices that support interactive learning experiences.

Technological Advancements in Hardware

Technological advancements in hardware are significantly influencing the tablet pc market in India. Innovations such as improved processors, enhanced battery life, and high-resolution displays are making tablets more appealing to consumers. As of 2025, the introduction of 5G connectivity in tablets is expected to enhance user experience, allowing for faster internet access and seamless streaming. These advancements are likely to attract a broader audience, including professionals and students, thereby expanding the tablet pc market. The continuous evolution of technology suggests that manufacturers will need to innovate consistently to meet the growing expectations of consumers.