The tablet notebook-display market is characterized by a dynamic competitive landscape, driven by rapid technological advancements and evolving consumer preferences. Key players such as Apple Inc (US), Microsoft Corporation (US), and Lenovo Group Limited (CN) are at the forefront, each adopting distinct strategies to enhance their market positioning. Apple Inc (US) continues to emphasize innovation, particularly in integrating advanced features into its iPad lineup, while Microsoft Corporation (US) focuses on expanding its Surface series, targeting both professional and educational sectors. Lenovo Group Limited (CN) appears to leverage its extensive manufacturing capabilities to offer competitively priced devices, thereby appealing to a broader consumer base. Collectively, these strategies contribute to a competitive environment that is increasingly defined by innovation and differentiation rather than mere price competition.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The market structure is moderately fragmented, with several key players exerting substantial influence. This fragmentation allows for a variety of offerings, catering to diverse consumer needs, while also fostering competition that drives innovation and quality improvements across the sector.

In October 2025, Apple Inc (US) announced the launch of its latest iPad Pro, featuring an M3 chip that significantly enhances processing power and graphics capabilities. This strategic move underscores Apple's commitment to maintaining its leadership in the premium segment of the tablet notebook-display market. By integrating cutting-edge technology, Apple aims to attract creative professionals and gamers, thereby reinforcing its brand loyalty and market share.

In September 2025, Microsoft Corporation (US) unveiled a new partnership with educational institutions to provide Surface devices at subsidized rates. This initiative is strategically important as it not only expands Microsoft's footprint in the education sector but also positions its products as essential tools for learning. By fostering relationships with schools, Microsoft is likely to cultivate long-term brand loyalty among young consumers, which could translate into future sales.

In August 2025, Lenovo Group Limited (CN) expanded its manufacturing operations in the US, aiming to reduce lead times and enhance supply chain resilience. This move is indicative of Lenovo's strategy to localize production, which may mitigate risks associated with global supply chain disruptions. By establishing a stronger domestic presence, Lenovo could potentially improve its competitive edge in the North American market.

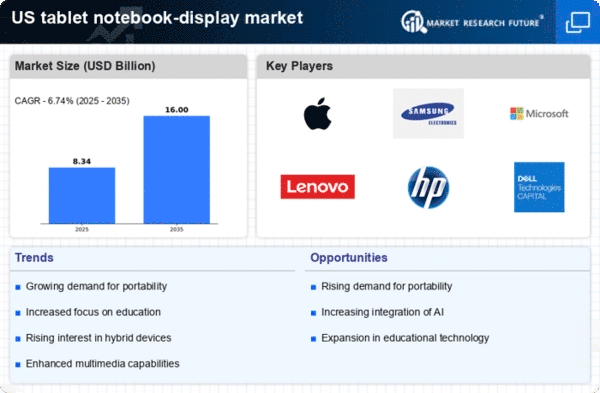

As of November 2025, the tablet notebook-display market is witnessing trends such as increased digitalization, a focus on sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies seek to combine resources and expertise to enhance product offerings. Looking ahead, competitive differentiation is likely to evolve, with a pronounced shift from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This evolution suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly competitive landscape.