Increase in Livestock Farming

The India Veterinary Medicine Market is experiencing a notable surge due to the increase in livestock farming. With the growing demand for dairy and meat products, farmers are investing in veterinary services to ensure the health and productivity of their animals. According to recent data, the livestock sector contributes significantly to India's agricultural GDP, accounting for approximately 4.11 percent. This growth in livestock farming necessitates the use of veterinary medicines to prevent diseases and enhance productivity, thereby driving the demand for veterinary services and products. As farmers become more aware of the importance of animal health, the veterinary medicine market is likely to expand further, reflecting a shift towards more sustainable and productive farming practices.

Growth of the Pet Care Industry

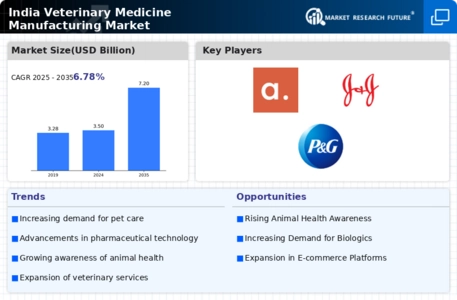

The India Veterinary Medicine Market is closely linked to the growth of the pet care industry, which has been expanding rapidly in recent years. With an increasing number of households adopting pets, there is a corresponding rise in the demand for veterinary services and products. The pet care market in India is projected to grow at a CAGR of 20 percent, indicating a robust demand for veterinary medicines, preventive care, and specialized treatments. This growth is further fueled by changing consumer attitudes towards pet ownership, where pets are increasingly viewed as family members. Consequently, the veterinary medicine market is likely to benefit from this trend, as pet owners seek high-quality healthcare solutions for their animals.

Rising Awareness of Animal Health

The India Veterinary Medicine Market is witnessing a transformation driven by the rising awareness of animal health among pet owners and livestock farmers. As the population becomes more educated about the importance of veterinary care, there is a growing demand for preventive healthcare measures, including vaccinations and regular check-ups. This trend is particularly evident in urban areas, where pet ownership is on the rise. Data suggests that the pet care market in India is projected to reach USD 490 million by 2025, indicating a substantial increase in spending on veterinary services. This heightened awareness is likely to propel the veterinary medicine market forward, as consumers seek quality healthcare solutions for their animals.

Government Initiatives and Policies

The India Veterinary Medicine Market is significantly influenced by government initiatives aimed at improving animal health and welfare. The government has implemented various policies to promote veterinary services, including the National Livestock Mission, which focuses on enhancing livestock productivity and health. These initiatives often include subsidies for veterinary medicines and vaccinations, making them more accessible to farmers. Furthermore, the government's emphasis on disease control and prevention, particularly in livestock, has led to increased investments in veterinary infrastructure. As a result, the veterinary medicine market is likely to benefit from these supportive policies, fostering a more robust veterinary healthcare system across the country.

Technological Advancements in Veterinary Medicine

The India Veterinary Medicine Market is being reshaped by technological advancements that enhance the efficiency and effectiveness of veterinary care. Innovations such as telemedicine, diagnostic tools, and advanced treatment options are becoming increasingly available to veterinarians. These technologies not only improve the quality of care but also streamline operations within veterinary practices. For instance, the introduction of mobile veterinary clinics has made it easier for farmers in remote areas to access veterinary services. As these technologies continue to evolve, they are expected to drive growth in the veterinary medicine market, enabling practitioners to provide better care and improve animal health outcomes across India.