Rising Pet Ownership Rates

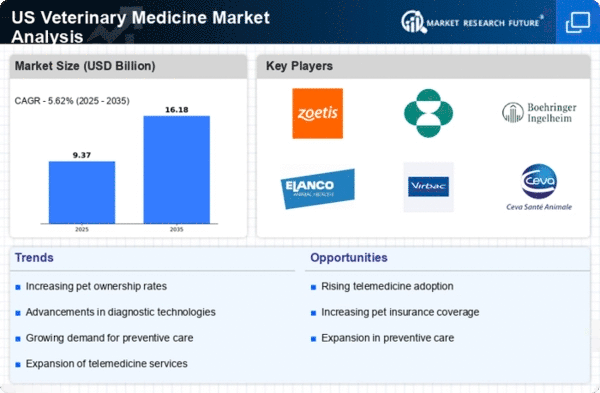

The veterinary medicine market experiences a notable boost due to the increasing rates of pet ownership across the United States. As more households welcome pets, the demand for veterinary services and products escalates. According to recent data, approximately 67% of U.S. households own a pet, which translates to around 85 million families. This surge in pet ownership correlates with a heightened need for veterinary care, including routine check-ups, vaccinations, and emergency services. Consequently, the veterinary medicine market is likely to see sustained growth as pet owners prioritize their animals' health and well-being. Furthermore, the trend of adopting pets from shelters and rescues may also contribute to the demand for veterinary services, as these animals often require immediate medical attention and ongoing care.

Growing Awareness of Animal Health

There is a rising awareness among pet owners regarding the importance of animal health, which significantly impacts the veterinary medicine market. Educational campaigns and increased access to information have empowered pet owners to make informed decisions about their pets' health. This heightened awareness has led to a greater emphasis on preventive care, vaccinations, and regular veterinary visits. As a result, the veterinary medicine market is witnessing a shift towards more proactive health management strategies. Reports indicate that spending on preventive care has increased by approximately 20% over the past few years, reflecting a cultural shift in how pet owners approach their animals' health. This trend is likely to continue, further driving demand for veterinary services and products.

Increase in Pet Insurance Adoption

The veterinary medicine market is experiencing a transformation due to the increasing adoption of pet insurance among pet owners. As more individuals recognize the financial benefits of insuring their pets, the demand for veterinary services is likely to rise. Pet insurance can alleviate the financial burden associated with unexpected medical expenses, encouraging pet owners to seek veterinary care more readily. Recent statistics indicate that approximately 30% of pets in the U.S. are now insured, a figure that has been steadily increasing. This trend not only enhances the accessibility of veterinary services but also promotes a culture of preventive care, as insured pet owners are more inclined to pursue regular check-ups and vaccinations. Consequently, the veterinary medicine market stands to benefit from this growing trend.

Advancements in Veterinary Technology

Technological innovations play a pivotal role in shaping the veterinary medicine market. The integration of advanced diagnostic tools, telemedicine, and electronic health records enhances the efficiency and effectiveness of veterinary practices. For instance, the use of telemedicine allows veterinarians to consult with pet owners remotely, thereby expanding access to care. Moreover, the market for veterinary diagnostic equipment is projected to reach approximately $2.5 billion by 2026, indicating a robust growth trajectory. These advancements not only improve patient outcomes but also streamline operations within veterinary practices. As technology continues to evolve, the veterinary medicine market is expected to adapt, leading to improved service delivery and increased client satisfaction.

Regulatory Developments in Veterinary Medicine

The veterinary medicine market is influenced by various regulatory developments that shape the landscape of veterinary practices. Changes in regulations regarding drug approvals, animal welfare standards, and veterinary licensing can have profound effects on the industry. For instance, the introduction of new guidelines for the use of antibiotics in livestock has prompted veterinarians to adopt alternative treatment methods, thereby impacting the market for veterinary pharmaceuticals. Additionally, compliance with evolving regulations necessitates ongoing education and training for veterinary professionals, which can drive demand for specialized services. As the regulatory environment continues to evolve, the veterinary medicine market must adapt to ensure compliance while maintaining high standards of care.