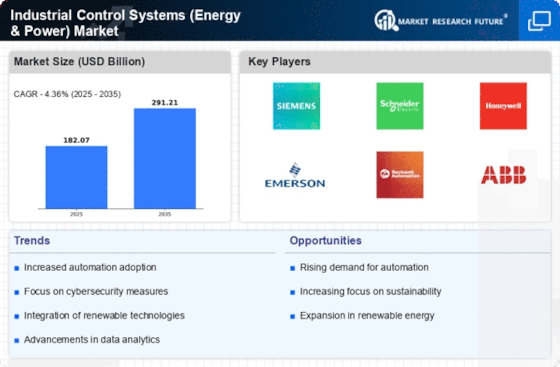

Leading market players are investing heavily in R&D to expand their product lines, which will help the industrial control systems (energy & power) market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, industrial control systems (energy & power) industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the industrial control systems (energy & power) industry to benefit clients and increase the market sector. In recent years, the industrial control systems (energy & power) industry has offered some of the most significant advantages to medicine. Major players in the industrial control systems (energy & power) market, including General Electric Company (U.S.), Schneider Electric SE (France), Rockwell Automation, Inc. (U.S.), Honeywell International, Inc. (U.S.), and others, are attempting to increase market demand by investing in R&D operations.Hitachi, Ltd. is a Japanese multinational firm based in Chiyoda, Tokyo, Japan. It is the parent firm of the Hitachi Group (Hitachi Gurpu), and was once a part of the Nissan zaibatsu, DKB Group, and Fuyo Group of enterprises before DKB and Fuji Bank (the core Fuyo Group entity) combined to establish the Mizuho Financial Group. As of 2020, Hitachi's business ranges from IT to infrastructure, including AI, the Internet of Things, and big data.Hitachi is traded on the Tokyo and Nagoya stock exchanges, and its Tokyo stock exchange listing is a component of the Nikkei 225 and TOPIX Core30 indices. It is placed 38th in the Fortune 500 for 2012 and 129th in the Forbes 2000 for 2012.

In September Hitachi, Ltd. announced the acquisition of Flexware Innovation, Inc., a manufacturing Systems Integrator (SI).Following the acquisition, Hitachi will strengthen and expand its business in North America in the domains of MES, SCADA, Business Intelligence (BI), Software Development, and ERP implementation capabilities, as well as accelerate digitalisation with JR Automation, which specialises in robotic SI and automation.PepsiCo, Inc. is an American food, snack, and beverage conglomerate headquartered in Purchase, New York. PepsiCo's operations span the entire food and beverage industry. It is in charge of product manufacture, distribution, and marketing. The Pepsi-Cola Company and Frito-Lay, Inc. merged to establish PepsiCo in 1965. PepsiCo has subsequently expanded beyond its eponymous product, Pepsi Cola, to include a vast array of food and beverage brands.The most recent and largest acquisition was Pioneer Foods in 2020 for US$1.7 billion, with the Quaker Oats Company in 2001, which gave the Gatorade brand to the Pepsi portfolio, and Tropicana Products in 1998 preceding it. In June 2022, PepsiCo India announced an extra INR 1.86 crore investment in expanding its food manufacturing factory in Kosi Kalan, Mathura, Uttar Pradesh, to create the Doritos brand of cornflakes. The overall investment by PepsiCo in its largest Greenfield Foods production unit, which produces Lay's potato chips, will then be Rs 1,022 crore.