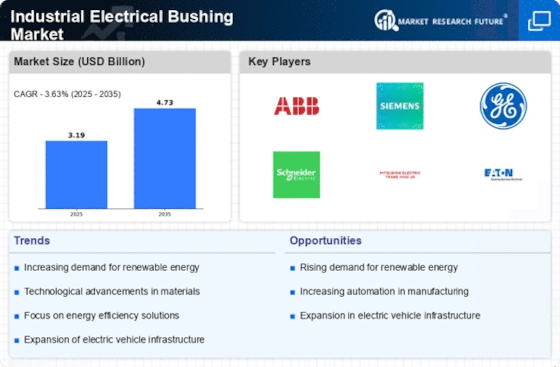

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is driving the Industrial Electrical Bushing Market. As countries strive to meet energy transition goals, the demand for wind and solar power generation is surging. This shift necessitates the use of high-quality electrical bushings to ensure efficient energy transmission and distribution. In 2025, the renewable energy sector is projected to account for a significant portion of new energy installations, thereby boosting the need for reliable electrical components. The Industrial Electrical Bushing Market is likely to benefit from this trend, as manufacturers focus on producing bushings that can withstand the unique challenges posed by renewable energy systems.

Increased Focus on Safety Standards

The heightened focus on safety standards is influencing the Industrial Electrical Bushing Market. Regulatory bodies are implementing stricter guidelines to ensure the safety and reliability of electrical components. This trend is compelling manufacturers to invest in high-quality bushings that meet or exceed these standards. In 2025, the market is likely to witness a surge in demand for bushings that comply with international safety regulations, as industries prioritize risk management and operational safety. Consequently, this focus on safety is expected to drive growth within the Industrial Electrical Bushing Market, as companies seek to enhance their product offerings.

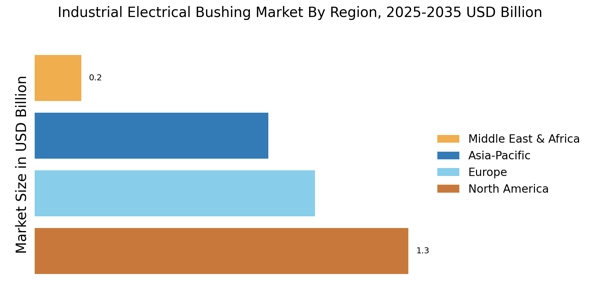

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are propelling the Industrial Electrical Bushing Market. Governments are investing heavily in upgrading and expanding electrical grids to accommodate growing energy demands. This investment is expected to lead to an increase in the installation of electrical equipment, including bushings, which are critical for maintaining system integrity. In 2025, the market for electrical infrastructure is anticipated to grow, with a notable rise in the demand for industrial electrical bushings. This trend suggests that the Industrial Electrical Bushing Market will experience robust growth as infrastructure projects continue to unfold.

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle infrastructure is significantly impacting the Industrial Electrical Bushing Market. As the adoption of electric vehicles continues to rise, there is a corresponding need for robust charging infrastructure. This development requires reliable electrical components, including bushings, to ensure efficient power distribution. In 2025, the market for electric vehicle charging stations is projected to grow substantially, leading to increased demand for industrial electrical bushings. This trend suggests that the Industrial Electrical Bushing Market will play a crucial role in supporting the electrification of transportation, thereby contributing to overall market growth.

Technological Innovations in Electrical Components

Technological innovations are reshaping the Industrial Electrical Bushing Market. Advancements in materials science and engineering are leading to the development of more durable and efficient bushings. These innovations enhance the performance and longevity of electrical systems, making them more attractive to end-users. In 2025, the market is expected to see a rise in the adoption of smart bushings equipped with sensors that monitor performance in real-time. This integration of technology not only improves reliability but also aligns with the growing trend of automation in industrial applications, indicating a promising future for the Industrial Electrical Bushing Market.