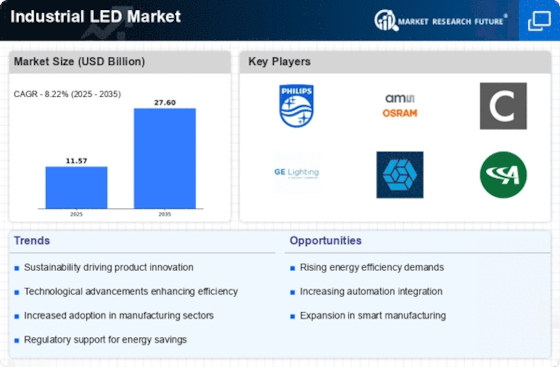

The Industrial LED Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, sustainability initiatives, and increasing demand for energy-efficient lighting solutions. Key players such as Philips (NL), Osram (DE), and Cree (US) are strategically positioned to leverage these growth drivers. Philips (NL) focuses on innovation in smart lighting solutions, while Osram (DE) emphasizes its commitment to sustainability through eco-friendly products. Cree (US) is known for its cutting-edge LED technology, which enhances energy efficiency and performance. Collectively, these strategies not only enhance their market presence but also shape a competitive environment that prioritizes innovation and sustainability.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach appears to be a response to the growing demand for customized solutions in various regions. The market structure is moderately fragmented, with several players vying for market share. However, the influence of key players like Signify (NL) and GE Lighting (US) is substantial, as they continue to innovate and expand their product offerings, thereby intensifying competition.

In August 2025, Signify (NL) announced a partnership with a leading technology firm to develop advanced smart lighting systems that integrate AI capabilities. This strategic move is likely to enhance their product portfolio and position them as a leader in the smart lighting segment. The integration of AI into lighting solutions not only improves energy efficiency but also offers enhanced user experiences, which could significantly boost market demand.

In September 2025, GE Lighting (US) unveiled a new line of industrial LED fixtures designed specifically for harsh environments. This launch reflects GE's commitment to addressing the unique needs of industrial clients, thereby expanding its market reach. The introduction of specialized products is indicative of a broader trend where companies are tailoring their offerings to meet specific industry requirements, which may enhance customer loyalty and market penetration.

In July 2025, Cree (US) expanded its manufacturing capabilities by investing in a new facility focused on producing high-performance LED components. This investment is strategically important as it not only increases production capacity but also positions Cree to respond more effectively to the growing demand for energy-efficient lighting solutions. Such expansions are crucial in a market where supply chain reliability and production efficiency are paramount.

As of October 2025, the competitive trends in the Industrial LED Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, advanced technology, and reliable supply chains. This shift underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive edge in the rapidly changing market.

Leave a Comment