Expansion of Oil and Gas Sector

The Industrial Nitrogen Market is significantly impacted by the expansion of the oil and gas sector. Nitrogen is utilized in enhanced oil recovery techniques and in the maintenance of pressure in pipelines. As global energy demands rise, the oil and gas industry is likely to expand, leading to increased nitrogen consumption. In 2023, the oil and gas sector accounted for approximately 25% of the total nitrogen usage, indicating its critical role in the Industrial Nitrogen Market. This trend is expected to persist as energy companies seek to optimize production and reduce operational costs.

Growth in Pharmaceutical Manufacturing

The Industrial Nitrogen Market is significantly influenced by the pharmaceutical sector, where nitrogen plays a critical role in various manufacturing processes. It is utilized in the production of active pharmaceutical ingredients and in the preservation of sensitive compounds. The pharmaceutical industry has been expanding, with a projected growth rate of around 5% annually. This growth is likely to enhance the demand for nitrogen, as it is essential for maintaining the integrity and stability of pharmaceutical products. Consequently, the Industrial Nitrogen Market stands to benefit from this upward trend in pharmaceutical manufacturing.

Environmental Regulations and Compliance

The Industrial Nitrogen Market is also shaped by stringent environmental regulations aimed at reducing emissions and promoting sustainable practices. Nitrogen is often used in processes that minimize waste and enhance energy efficiency. As industries strive to comply with these regulations, the demand for nitrogen is likely to increase, as it is integral to various environmentally friendly processes. The push for sustainability is expected to drive innovation and investment in nitrogen applications, thereby positively impacting the Industrial Nitrogen Market.

Rising Demand in Food and Beverage Sector

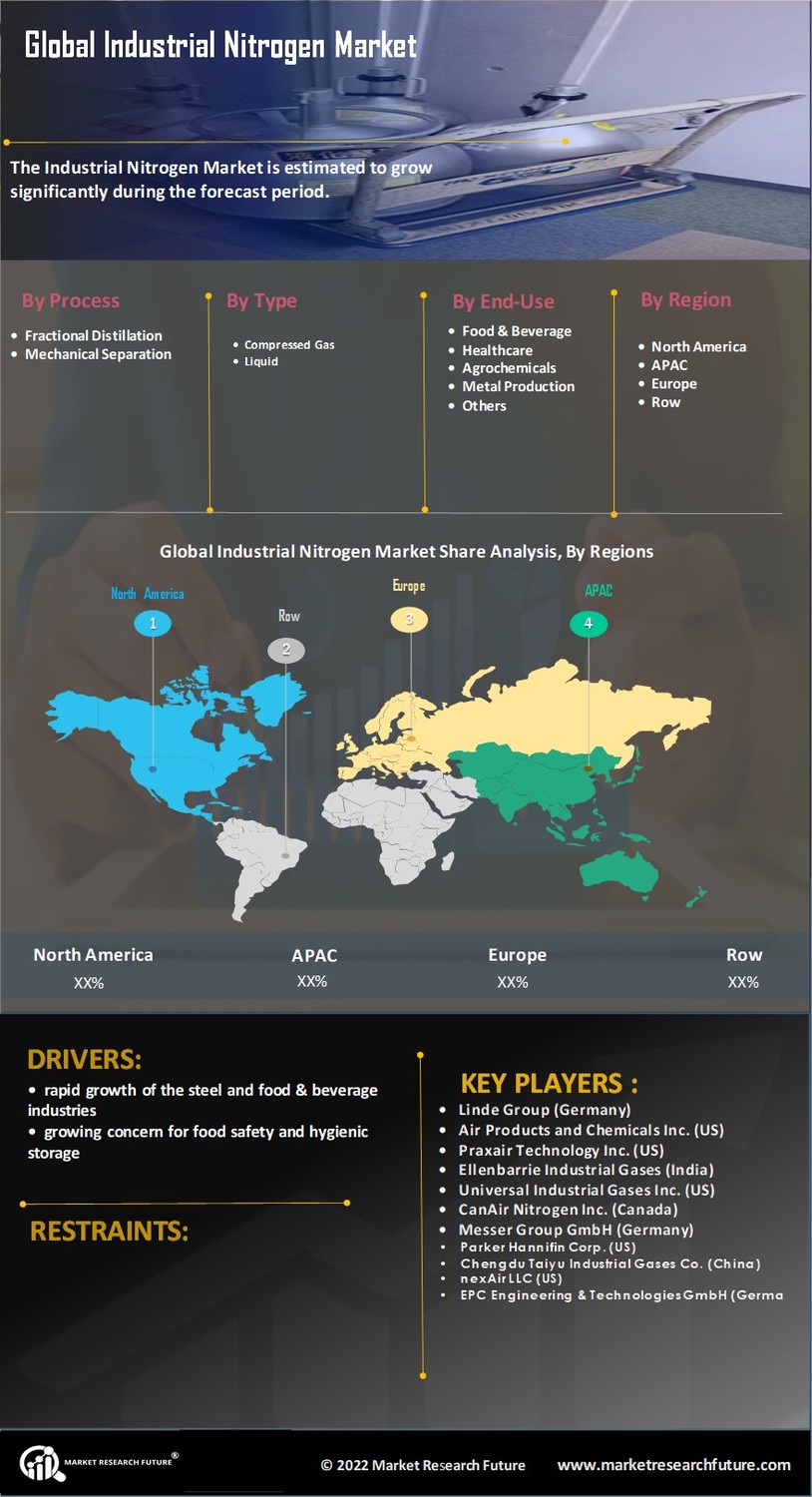

The Industrial Nitrogen Market experiences a notable surge in demand from the food and beverage sector. Nitrogen is extensively utilized in food preservation, packaging, and processing, ensuring product freshness and extending shelf life. As consumer preferences shift towards packaged and processed foods, the need for nitrogen in these applications is likely to increase. In 2023, the food and beverage segment accounted for approximately 30% of the total nitrogen consumption, indicating a robust growth trajectory. This trend is expected to continue, driven by the rising global population and changing dietary habits, which further propels the Industrial Nitrogen Market.

Increasing Use in Electronics Manufacturing

The Industrial Nitrogen Market is witnessing a rise in demand from the electronics manufacturing sector. Nitrogen is employed in the production of semiconductors and other electronic components, where it serves to create an inert atmosphere, preventing oxidation and contamination. As the electronics industry continues to evolve, with advancements in technology and increased production capacities, the need for nitrogen is expected to grow. In 2023, the electronics sector represented approximately 20% of the total nitrogen consumption, suggesting a strong correlation between technological advancements and the Industrial Nitrogen Market.