Top Industry Leaders in the Industrial Separators Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Industrial Separator industry are:

- Abengoa Solar, SA (Spain)

- Acciona Energy (Spain)

- GE Renewable Energy (France)

- TSK Flagsol Engineering GmbH (Germany)

- Enel Green Power (Italy)

- BrightSource Energy (US)

- Attantica Yield PLO (UK)

- eSolar inc. (US)

- SolarReserve (US)

- ACWA Power (Saudi Arabia)

- Chiyoda Corporation (Japan)

- Alsolen (Morocco)

- Soligua (Italy)

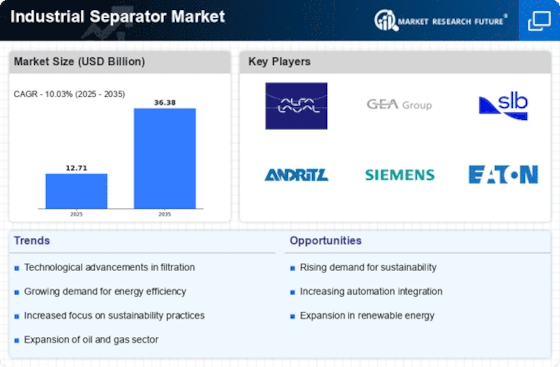

The industrial separator market, encompassing a vast array of equipment for material separation, is a dynamic stage where established players and nimble innovators vie for dominance. Understanding the competitive landscape is crucial for both existing participants and prospective entrants. This analysis delves into the key strategies, market share factors, emerging trends, and overall scenario driving competition in this multifaceted market.

Key Player Strategies:

Global Giants: Established heavyweights like GEA, Alfa Laval, and SPX Flow rely on their expansive product portfolios, robust distribution networks, and strong brand recognition to maintain market leadership. They leverage economies of scale to offer cost-competitive solutions and invest heavily in R&D for technological advancements.

Regional Specialists: Regional players like Burgess-Manning in the US and Nippon Magnetics in Asia cater to specific geographical needs and regulations. They often possess deep application expertise in niche segments, forging strong relationships with local stakeholders.

Innovation Hubs: Smaller, technology-driven companies like GIAMAG Technologies and Envirosuite are pushing the boundaries with novel separation technologies like membrane filtration and advanced hydrocyclones. They target specific segments with differentiated offerings, challenging established players through superior performance and sustainability.

Market Share Analysis:

Technology Segmentation: Market share varies significantly across separator technologies. Filtration dominates due to its versatility, while centrifuges hold sway in oil and gas applications. Newer technologies like hydrocyclones are gaining traction in water treatment and mining.

End-User Focus: The market is fragmented across diverse end-user industries, each with unique needs. Chemical processing leads the pack, followed by oil and gas, water treatment, and food & beverage. Understanding and catering to specific industry demands is key to gaining market share.

Geographical Dynamics: Asia Pacific, driven by rapid industrialization and stringent environmental regulations, is the fastest-growing region. Europe and North America remain mature markets with strong established players, while Latin America and Africa offer untapped potential.

Emerging Trends:

Sustainable Solutions: Eco-conscious separators with minimized energy consumption and waste generation are gaining traction. Demand for water recycling and effluent treatment technologies is accelerating, driven by regulatory pressure and resource scarcity.

Digitalization and Smart Systems: Integration of sensors, data analytics, and automation is transforming separator operations. Predictive maintenance, remote monitoring, and optimized process control are increasingly sought-after features.

Modular and Compact Designs: Space constraints and flexibility needs are driving demand for modular and compact separators, particularly in urban environments and decentralized production facilities.

Overall Competitive Scenario:

The industrial separator market is characterized by intense competition, with players employing diverse strategies to secure market share. Technological innovation, specialization in niche segments, and adaptation to regional and industry-specific needs are crucial for differentiation. Sustainability, digitalization, and compact designs are shaping the future landscape, presenting both challenges and opportunities for established players and innovative newcomers. Understanding these trends and strategically aligning with them will be key to success in this ever-evolving market.

Latest Company Updates:

Abengoa Solar: Recent news includes expansion of its desalination business through acquisition of Befesa's water division, and development of innovative hybrid solar-desalination technologies.

Acciona Energy: Focuses on developing and operating renewable energy projects including CSP plants, and recently announced plans to invest €11 billion in renewables by 2030.

GE Renewable Energy: Actively involved in developing various separation technologies for oil & gas and other industries. Recent developments include launch of the Ecomagination® OWS 500 HP Oil and Water Separator, optimized for high flow rates and efficiency.

TSK Flagsol Engineering GmbH: A leading provider of CSP parabolic trough technology, focusing on improving efficiency and reducing costs. Recent news includes successful completion of the Noor Energy 1 CSP plant in Morocco.

Enel Green Power: Invests heavily in renewable energy projects worldwide, including CSP plants. Recent developments include successful grid integration of the Kathu CSP plant in South Africa.