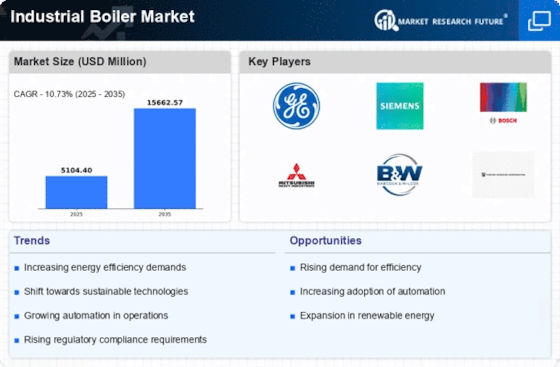

Rising Energy Demand

The Industrial Boiler Market is experiencing a surge in energy demand, driven by the expansion of manufacturing and industrial sectors. As economies grow, the need for efficient energy solutions becomes paramount. Industrial boilers play a crucial role in meeting this demand, providing steam and heat for various processes. According to recent data, the energy consumption in industrial applications is projected to increase by approximately 30% over the next decade. This trend indicates a robust growth trajectory for the industrial boiler sector, as companies seek to enhance productivity while minimizing energy costs. Furthermore, the shift towards cleaner energy sources is likely to influence the design and operation of industrial boilers, pushing manufacturers to innovate and adapt to changing market needs.

Environmental Regulations

The Industrial Boiler Market is under increasing pressure from stringent environmental regulations aimed at reducing emissions and promoting sustainability. Governments worldwide are implementing policies that mandate lower emissions from industrial processes, compelling companies to upgrade their boiler systems. The introduction of regulations such as the Clean Air Act has led to a significant transformation in boiler technology, with a focus on reducing nitrogen oxides and particulate matter. As a result, the market for low-emission boilers is projected to grow substantially, with estimates indicating a potential increase of 25% in demand for compliant systems over the next five years. This regulatory landscape is likely to drive innovation and investment in cleaner technologies within the industrial boiler sector.

Technological Advancements

Technological advancements are significantly shaping the Industrial Boiler Market. Innovations in boiler design, materials, and control systems are enhancing efficiency and reducing emissions. For instance, the integration of advanced monitoring systems allows for real-time performance analysis, leading to optimized operations. The market is witnessing a shift towards high-efficiency boilers, which can achieve efficiency ratings exceeding 90%. This transition is not only beneficial for operational costs but also aligns with environmental regulations. As industries increasingly adopt smart technologies, the demand for modernized industrial boilers is expected to rise. The ongoing research and development efforts in this sector suggest a promising future, with potential breakthroughs that could redefine operational standards.

Shift Towards Renewable Energy

The shift towards renewable energy sources is influencing the Industrial Boiler Market in profound ways. As industries seek to reduce their carbon footprint, there is a growing interest in biomass and other renewable fuel options for boiler operations. This transition is not only environmentally driven but also economically motivated, as renewable energy can offer cost savings in the long run. The market for biomass boilers, for instance, is expected to witness a compound annual growth rate of around 15% in the coming years. This trend indicates a significant opportunity for manufacturers to develop and market boilers that can efficiently utilize renewable fuels, thereby aligning with global sustainability goals and enhancing their competitive edge.

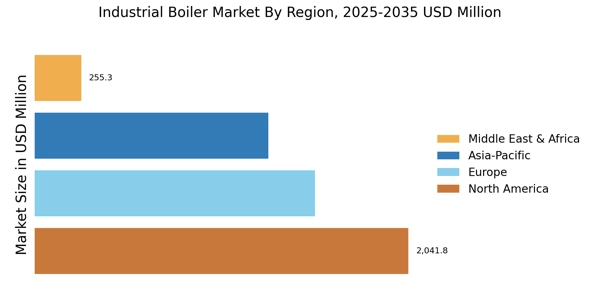

Increased Investment in Infrastructure

Increased investment in infrastructure is a key driver for the Industrial Boiler Market. As countries invest in upgrading their industrial facilities, the demand for efficient and reliable boiler systems is on the rise. This trend is particularly evident in emerging markets, where industrialization is accelerating. The construction of new manufacturing plants and the modernization of existing facilities are expected to create substantial opportunities for boiler manufacturers. Recent reports suggest that infrastructure spending could reach trillions of dollars over the next decade, with a significant portion allocated to energy systems. This influx of investment is likely to stimulate growth in the industrial boiler sector, as companies seek to enhance operational efficiency and meet rising energy demands.