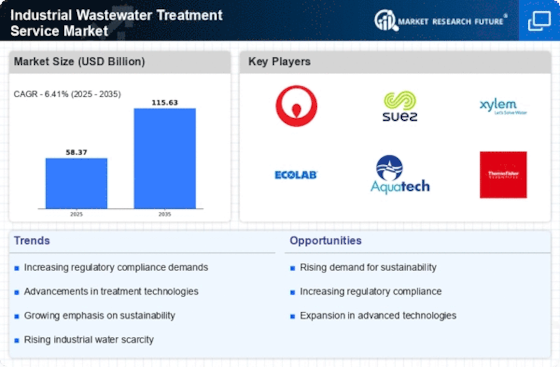

Growing Demand for Water Reuse

The rising demand for water reuse is a pivotal driver in the Industrial Wastewater Treatment Service Market. As water scarcity becomes a pressing issue in many regions, industries are increasingly looking to recycle and reuse treated wastewater. This trend is particularly evident in sectors such as agriculture, manufacturing, and energy, where water is a critical resource. Recent studies indicate that the global market for water reuse is projected to grow at a compound annual growth rate of 15% over the next five years. This growing emphasis on sustainable water management practices is prompting industries to seek specialized wastewater treatment services that can facilitate effective water reuse. Consequently, the Industrial Wastewater Treatment Service Market is likely to benefit from this shift towards circular water economies, as businesses strive to minimize their environmental footprint while ensuring operational efficiency.

Rising Awareness of Sustainable Practices

The growing awareness of sustainable practices among industries is a crucial driver for the Industrial Wastewater Treatment Service Market. Companies are increasingly recognizing the importance of adopting environmentally friendly practices to enhance their corporate social responsibility profiles. This shift is driven by consumer preferences for sustainable products and services, as well as pressure from stakeholders to minimize environmental impacts. Recent surveys indicate that over 70% of consumers are willing to pay a premium for products from companies that demonstrate a commitment to sustainability. Consequently, industries are investing in advanced wastewater treatment services to reduce their ecological footprints and improve their sustainability ratings. This trend not only fosters market growth but also encourages innovation in treatment technologies. As sustainability becomes a core business strategy, the Industrial Wastewater Treatment Service Market is expected to thrive in response to these evolving consumer and regulatory expectations.

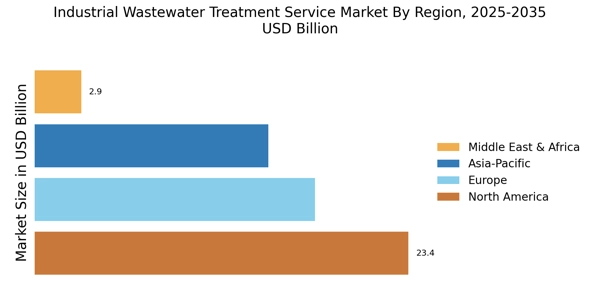

Increased Industrialization and Urbanization

The rapid pace of industrialization and urbanization is significantly influencing the Industrial Wastewater Treatment Service Market. As more industries establish operations in urban areas, the volume of wastewater generated is escalating, necessitating effective treatment solutions. This trend is particularly pronounced in developing regions, where industrial growth is often accompanied by inadequate wastewater management infrastructure. According to recent estimates, industrial wastewater generation is expected to increase by 20% over the next decade, creating a pressing need for efficient treatment services. Urbanization also leads to higher population densities, which further exacerbates the challenges associated with wastewater management. As a result, industries are compelled to invest in comprehensive wastewater treatment services to mitigate environmental impacts and comply with regulatory requirements. This burgeoning demand is likely to propel the growth of the Industrial Wastewater Treatment Service Market in the coming years.

Regulatory Compliance and Environmental Awareness

The Industrial Wastewater Treatment Service Market is experiencing a surge in demand due to stringent regulatory frameworks aimed at protecting water resources. Governments are increasingly enforcing laws that mandate the treatment of industrial wastewater before discharge. This regulatory pressure compels industries to invest in advanced treatment solutions, thereby driving market growth. For instance, the implementation of the Clean Water Act in various regions has led to a notable increase in compliance costs for industries. As a result, companies are seeking reliable wastewater treatment services to avoid penalties and ensure adherence to environmental standards. The heightened awareness of environmental issues among consumers and stakeholders further amplifies this trend, as businesses strive to enhance their sustainability profiles. Consequently, the Industrial Wastewater Treatment Service Market is poised for expansion as industries prioritize compliance and environmental stewardship.

Technological Advancements in Treatment Solutions

Innovations in technology are reshaping the Industrial Wastewater Treatment Service Market, offering more efficient and cost-effective treatment options. The advent of advanced treatment technologies, such as membrane bioreactors and advanced oxidation processes, has significantly improved the efficacy of wastewater treatment. These technologies not only enhance the quality of treated water but also reduce operational costs for industries. According to recent data, the adoption of such technologies has led to a 30% reduction in energy consumption in wastewater treatment facilities. Furthermore, automation and digitalization in treatment processes are streamlining operations, allowing for real-time monitoring and optimization. As industries increasingly recognize the benefits of these technological advancements, the demand for innovative wastewater treatment services is expected to rise, driving growth in the Industrial Wastewater Treatment Service Market.

Leave a Comment