Increased Focus on Patient-Centric Care

The Infusion Pump Software Market is witnessing a shift towards patient-centric care models, which prioritize the needs and preferences of patients. This trend is driving the development of infusion pump software that enhances user experience and engagement. Features such as customizable settings and user-friendly interfaces are becoming essential in meeting patient expectations. As healthcare providers aim to improve patient satisfaction and outcomes, the demand for infusion pump software that supports these objectives is likely to grow. This focus on patient-centric solutions may lead to further innovations in the infusion pump software market.

Regulatory Support and Compliance Standards

The Infusion Pump Software Market is significantly influenced by regulatory support and compliance standards established by health authorities. Stringent regulations ensure that infusion pump software meets safety and efficacy requirements, thereby fostering trust among healthcare providers and patients. Compliance with these standards not only enhances product credibility but also encourages manufacturers to innovate and improve their offerings. As regulatory bodies continue to emphasize patient safety, the demand for compliant infusion pump software is likely to increase, contributing to the overall growth of the market.

Rising Demand for Chronic Disease Management

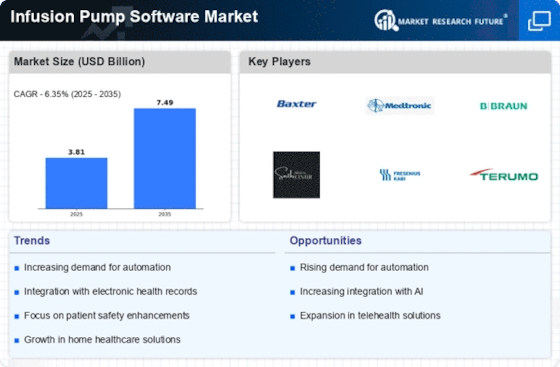

The Infusion Pump Software Market is experiencing a notable increase in demand due to the rising prevalence of chronic diseases such as diabetes and cancer. As healthcare providers seek to enhance patient outcomes, infusion pump software plays a crucial role in managing medication delivery for these conditions. According to recent data, the number of patients requiring continuous infusion therapy is projected to rise significantly, leading to an increased adoption of advanced infusion pump systems. This trend indicates a shift towards more personalized and effective treatment regimens, thereby driving the growth of the infusion pump software market.

Technological Advancements in Infusion Systems

Technological innovations are propelling the Infusion Pump Software Market forward. The integration of smart technologies, such as artificial intelligence and machine learning, into infusion systems enhances their functionality and efficiency. These advancements allow for real-time monitoring and data analytics, which can lead to improved patient safety and reduced medication errors. The infusion pump software market is expected to witness substantial growth as healthcare facilities increasingly adopt these sophisticated systems. Furthermore, the introduction of wireless connectivity features facilitates seamless data sharing among healthcare providers, further driving market expansion.

Growing Emphasis on Cost-Effectiveness in Healthcare

Cost-effectiveness is becoming a pivotal factor in the Infusion Pump Software Market as healthcare providers strive to optimize their operational expenses. The implementation of advanced infusion pump software can lead to significant cost savings by reducing medication waste and minimizing hospital stays. As healthcare systems face budget constraints, the demand for solutions that enhance efficiency while maintaining quality care is likely to rise. This trend suggests that infusion pump software, which can streamline processes and improve resource allocation, will play a vital role in the future of healthcare delivery.