Increased Focus on Patient Safety

The Intravenous Infusion Pump Market is witnessing an increased focus on patient safety, which is shaping the development and adoption of infusion technologies. Regulatory bodies are emphasizing the need for stringent safety standards and protocols to minimize risks associated with infusion therapies. This heightened awareness is prompting manufacturers to invest in research and development aimed at creating safer, more reliable devices. For instance, the introduction of features such as alarm systems and real-time monitoring capabilities is becoming standard in new infusion pump models. As healthcare providers prioritize patient safety, the demand for advanced infusion pumps that comply with regulatory requirements is likely to rise. This trend not only enhances patient care but also fosters trust in healthcare systems, ultimately contributing to market expansion.

Rising Incidence of Chronic Diseases

The Intravenous Infusion Pump Market is significantly influenced by the rising incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders. As these conditions require long-term treatment regimens, the demand for reliable infusion systems is escalating. Data indicates that the prevalence of diabetes alone is expected to reach 700 million cases by 2045, necessitating effective management solutions. Infusion pumps play a crucial role in delivering medications and nutrients to patients with chronic illnesses, thereby driving market growth. Additionally, the increasing number of outpatient procedures and home healthcare services further amplifies the need for portable and user-friendly infusion devices. This trend suggests a shift towards more patient-centered care, where infusion pumps are integral to managing complex treatment protocols.

Expansion of Healthcare Infrastructure

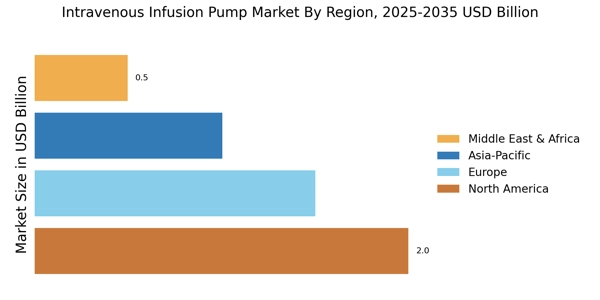

The Intravenous Infusion Pump Market is benefiting from the expansion of healthcare infrastructure across various regions. As healthcare facilities strive to improve their service offerings, there is a corresponding increase in the procurement of advanced medical devices, including infusion pumps. Recent statistics suggest that investments in healthcare infrastructure are on the rise, with many countries allocating substantial budgets to enhance their medical facilities. This expansion is particularly evident in emerging markets, where the demand for modern healthcare solutions is growing rapidly. The establishment of new hospitals and clinics is likely to drive the adoption of infusion pumps, as these devices are essential for delivering intravenous therapies. Furthermore, the integration of infusion pumps into newly developed healthcare facilities underscores their importance in modern medical practice.

Technological Innovations in Infusion Pumps

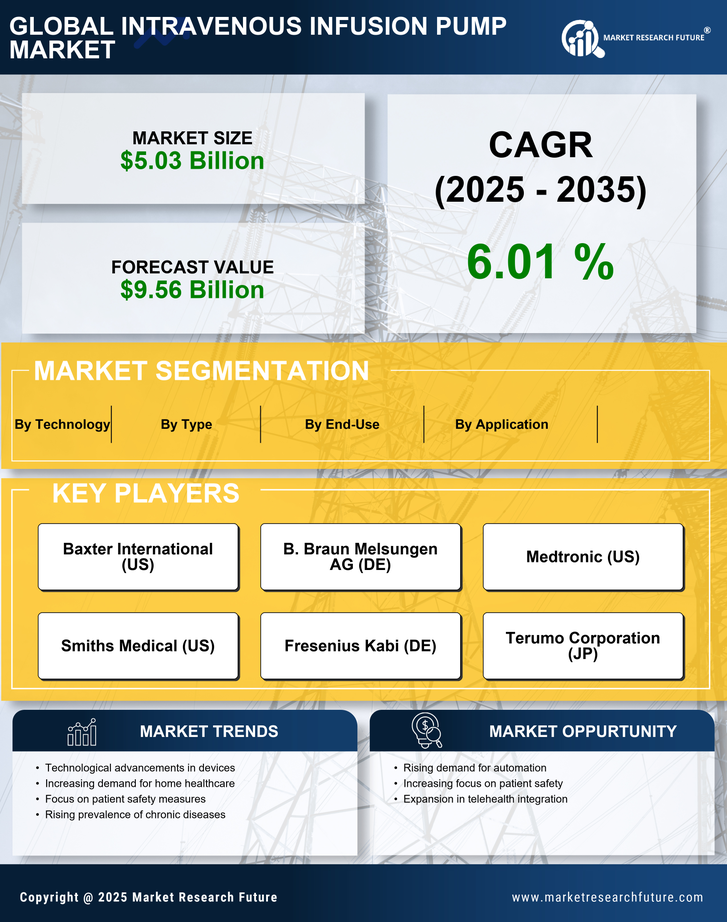

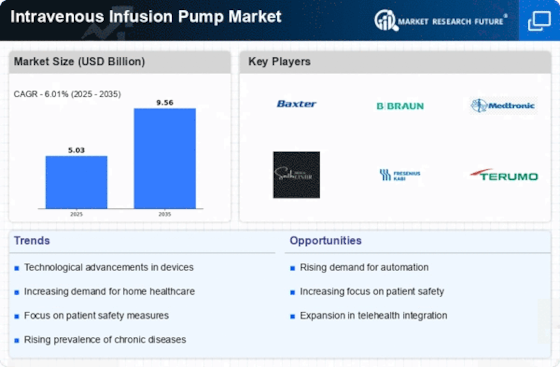

The Intravenous Infusion Pump Market is experiencing a surge in technological innovations that enhance the efficiency and safety of infusion therapies. Advanced features such as smart pumps, which integrate dose error reduction systems, are becoming increasingly prevalent. These innovations not only improve patient outcomes but also streamline clinical workflows. According to recent data, the infusion pump market is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years. This growth is driven by the increasing adoption of automated systems that minimize human error and enhance precision in drug delivery. Furthermore, the integration of wireless connectivity in infusion pumps allows for real-time monitoring and data collection, which is likely to transform patient management in various healthcare settings.

Growing Demand for Home Healthcare Solutions

The Intravenous Infusion Pump Market is experiencing a notable shift towards home healthcare solutions, driven by the increasing preference for at-home treatment options. Patients are increasingly seeking alternatives to traditional hospital settings, particularly for chronic disease management and post-operative care. This trend is supported by data indicating that the home healthcare market is projected to grow significantly, with infusion pumps being a critical component of this transition. The convenience and comfort of receiving treatment at home are appealing to patients and caregivers alike. Consequently, manufacturers are focusing on developing portable and user-friendly infusion devices that cater to this growing demand. This shift not only enhances patient satisfaction but also reduces healthcare costs, making home healthcare an attractive option for many.