Market Analysis

In-depth Analysis of Inorganic Fluorides Market Industry Landscape

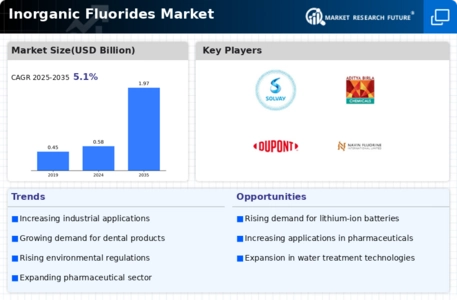

The Inorganic fluoride market is certainly dynamic with regard to the factors affecting its growth, as there are a wide range of industries to which applications span, from steel metallurgy, chemistry to electronics and medicine. The fluorine compound family, that is inorganic fluorides, is commonly used in different industries, giving it a major role in many industrial operations and applications. As one of the main driving forces, market dynamics include industrial markets with demands on metallurgy. Heterogen fluorides, especially aluminum fluoride, are which are used for to refine alumina, and feed the process of anodic oxidation, which helps to extract aluminum from a molten bath. In turn, the development and larger proportions of the metallurgical industry, plus the need for aluminum that is stable, light, and resistant to corrosion, all are reasons for the increasely higher need for inorganic fluorides.

The chemical firms utilize Inorganic Fluorides widely affecting the market dynamics of Inorganic Fluorides. Different inorganic fluorides, like hydrogen fluoride and sulfur hexafluoride, are used in different chemical process steps, such as the production of fluoro-compound and pharmaceutics. The abundance of versatile inorganic fluoride composition in syntheses and their distinctive attributes push them into wide range chemical application.

Regulations and environmental issues are based on global activities, resulting in the unique dynamics of Inorganic Fluorides market. Legality of rules necessary for protecting workers safety, nature as well as quality of products can have considerable effect on the choice of manufacturers. Environmental reactivity is an industry trait working with sustainable methods, responsible sourcing of raw materials and development of inorganic fluoride formulas ecofriendly enough.

Cost efficacy represents a vital balancing element in the dynamics of the fluorides market sector. Industries search for the cheap alternatives but do not compromise on quality and performance of inorganic fluorides. While on the other hand manufacturers always like to achieve the right product price with the highest efficacy. Such low costs which are crucial for both the producers and consumers, becomes true for keeps and stimulates innovation and competition as well.

The international relations have profound implications for the backward and forward linkages of the Inorganic Fluorides also. The economic situation directly controls the operations of industry, facilitates infrastructure development and thus determines the demand for inorganic fluorides by different appications. The performance of certain markets reflect the character and trends of the economy, since industries will either increase or decrease production depending on the economic situation at hand.

With innovations in technology as engines of inorganic fluorides market, it is dealing with the ever-changing market landscape. Continuous research and the development of new methods help process better extraction and contamination elimination, whereas new applications are worked out for inorganic fluorides. The introduction of more innovative technologies to create an interplay with production processes, product quality, and hopefully the exploration of the inorganic fluoride possibilities in different sectors would be very instrumental.

Leave a Comment