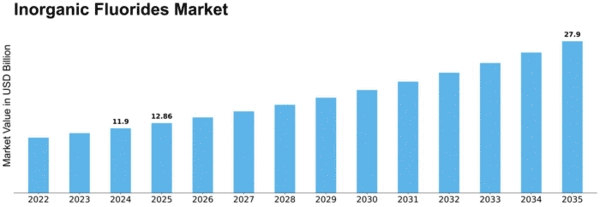

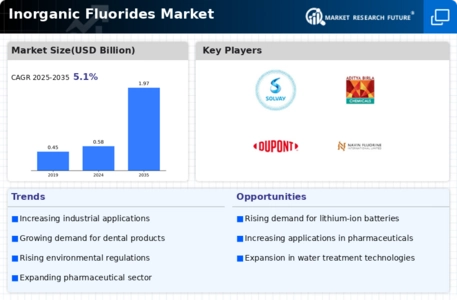

Inorganic Fluorides Size

Inorganic Fluorides Market Growth Projections and Opportunities

The Inorganic Fluorides Market's development is affected by a group of factors. They all, combining together, determine the market dynamics and the level of growth. The prime element and hence the growth of the Inorganic Fluorides Market is because they are widely used in the aluminium, chemical and electronics sphere. Industrial enzymes, lanugo fluorinated chemicals and electronic components are some critical functions of inorganic fluorides such as aluminum fluoride, hydrogen fluoride, and sodium fluoride. On the global scale the FDCA is a key contributor to the markets growth, which is due to growth of the end-user sectors such as nanotech and automotive and propitious technical developments.

The aluminium sector is a key area of influence for the organic fluoride market. Aluminum fluoride, among them, is a key one-member team in the production process, which is particularly in the Hall-Héroult process, the first method for aluminum smelting. The necessity of aluminum parts that are both lightweight and resistant to corrosion, the main demand of the industries including automotive, aerospace, and packaging, results in direct growth of aluminum market. As aluminum industry expands, their requirement for inorganic fluorides is more and more demanded for the use of this fluorides in the aluminium making chain.

With chemical industry is taking lead in driving the growth Inorganic Fluorides Market. This enables us to describe different applications for the inorganic fluorides, such as the fluorinated agents which play an important role in their development of various pharmaceuticals such as agrochemicals and specialty chemicals. The existence of fluorine-containing branches imparts exclusive characters to them, such as, a high chemical stability and low sensitivity to elevated temperatures. They are thus of much utility in a variety of other chemical processes. The thoroughness of chemical industry and the tendency of fluorinated agents increased the availability of inorganic fluorides.

The electronic components producers are one of the major buyers of the inorganic fluorides which are an essential ingredient of their manufacturing process. Hydrofluoric acid is one of such reactive etchants which hydrogen fluoride is important etchant in fabricating semiconductor devices. Its selective etching in silicon dioxide and other materials is the very thing that plays is place in the mass production of microelectronic devices. With time, hydrogen fluoride and other inorganic fluorides used in the electronics industry that are advancing will continue to drive the market since they dictate the direction of the market.

Geopolitics and the facilities of natural resources represent the two major factors that determine the evolution of the Inorganic Fluorides Market. A mineral, fluorspar is the one of the main sources of fluorine for producing inorganic fluorides and is being mined in many regions of the world. For example, any significant developments in geopolitics, trade barriers or disturbances in the rare elements, such flow air fluorspar deposits, can have direct influences on the supply chain and price of fluorspar. Entering into the market is responding to the geopolitical changes and searching for other substitute supply or inorganic fluoride producers.

Leave a Comment