Market Trends

Key Emerging Trends in the Inorganic Fluorides Market

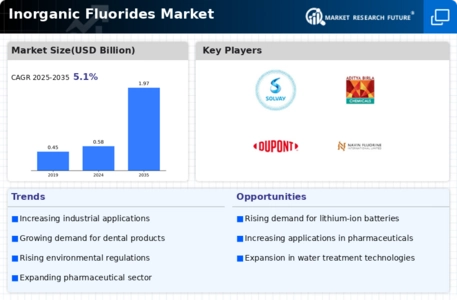

The Inorganic Fluoride Market is observing certain trends mainly due to rising demand in diverse industrial applications, innovation in the engineering sector and changing global market conditions of the chemical Industrial Side. Organic fluorides exhibiting chemical reactivity and stability among high chemical compounds are used in different industrial applications which contain fluorine. The increasingly popular demand for inorganic fluorides in the aluminum production process, where they are mainly added as fluxing agents for lower the melting point of alumina and faster the smelting of aluminum can also be identified as a main trend. Seeing that the demand for Aluminum parties on the rise worldwide, the Inorganic Flourides Market benefit from the steady growth, mostly in the regions that have a huge number of aluminum smelting centers.

The electronic and semiconductor industry is the biggest driver of developments which contribute to the Inorganic Fluoride Market. Semiconductor industry uses inorganic fluorides such as hydrogen fluoride and fluorinated gases as etching, cleaning and deposition agents for their microchip fabrication processes. Since electronics industry is becoming more and more specialized in the realm of small but powerful electronic devices with the development of smaller and more powerful electronic devices the demand for fluorides is rising.

Inorganic fluorides market trends are also subject to the development of a technology, especially in the sphere of batteries on the base of fluor. In addition, fluoride-ion batteries are considered as a promising substitute for the lithium-ion batteries, which is done through the utilization of inorganic fluorides as key components for the devices. The use of fluoride ions with their distinctive electrochemical characteristics explains the higher energy density and the enhanced capability of fluoride-based batteries, provoking the developments in the field.

Global chemical industry is under new light concerning changing playing field as sectors advance. The fluorides of inorganic nature are used for their catalytic properties in the creation of various chemical substances such as fluoropolymers used in fabrication of high strength elastomers and plastics, coatings etc. The ease of incorporating inorganic fluorides in several synthsis processes is one of the reasons why they are necessary in promoting a wide range of industrial processes.

The formation of business collaborations and partnerships among the industry players are nowadays the conspicuous feature. The organizations that specialize the synthesis and distribution of inorganic fluorides are forging associations to consolidate their market strength, pool their technical capabilities, and exploit new market developments. These collaborations in turn facilitate the development of the Inorganic Fluorides Market resulting in maintaining the pace of innovation, considering the flexibility of demand and supply from varying end-use markets.

Leave a Comment