Adoption of Drones in Energy Sector

The Inspection Drone Market is significantly influenced by the energy sector's adoption of drone technology. Drones are increasingly utilized for inspecting power lines, wind turbines, and solar panels, providing real-time data and reducing downtime. The energy sector's investment in drone technology is expected to surpass USD 800 million by 2025, driven by the need for efficient monitoring and maintenance. This trend suggests that as energy companies seek to optimize their operations and reduce costs, the demand for inspection drones will likely continue to rise, further solidifying their role in the energy landscape.

Growing Focus on Safety and Compliance

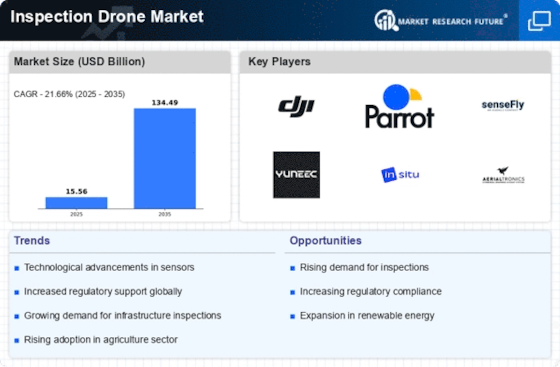

The Inspection Drone Market is increasingly shaped by a growing focus on safety and regulatory compliance. Industries such as construction and energy are under pressure to adhere to stringent safety standards, prompting the adoption of drones for inspections. Drones can access hard-to-reach areas, minimizing risks associated with manual inspections. As regulations evolve, the market for inspection drones is expected to expand, with estimates suggesting a growth rate of 12% over the next five years. This emphasis on safety and compliance underscores the critical role of drones in enhancing operational safety across various sectors.

Integration of AI and Machine Learning

The Inspection Drone Market is witnessing a transformative shift with the integration of artificial intelligence and machine learning technologies. These advancements enable drones to analyze data in real-time, enhancing their inspection capabilities. For instance, AI algorithms can identify structural anomalies and predict maintenance needs, thereby improving decision-making processes. The market for AI-driven inspection drones is anticipated to grow at a rate of 20% annually, indicating a strong trend towards automation and data-driven insights. This integration not only increases efficiency but also positions drones as essential tools in various inspection applications.

Cost Efficiency and Operational Benefits

The Inspection Drone Market is driven by the cost efficiency and operational benefits that drones provide. Traditional inspection methods often involve significant labor costs and time delays. In contrast, drones can conduct inspections in a fraction of the time, leading to substantial cost savings. Recent studies indicate that companies utilizing drones for inspections can reduce operational costs by up to 30%. This financial incentive, coupled with the ability to gather high-quality data quickly, positions drones as a preferred choice for many industries. As organizations seek to optimize their resources, the demand for inspection drones is likely to grow.

Increased Demand for Infrastructure Inspections

The Inspection Drone Market experiences heightened demand due to the growing need for infrastructure inspections. As urbanization accelerates, the maintenance of bridges, roads, and buildings becomes critical. Drones offer a cost-effective and efficient solution for conducting these inspections, reducing the need for scaffolding and manual labor. According to recent data, the market for infrastructure inspection drones is projected to reach USD 1.5 billion by 2026, reflecting a compound annual growth rate of approximately 15%. This trend indicates that stakeholders are increasingly recognizing the value of drones in enhancing safety and operational efficiency in infrastructure management.