Rising Diabetes Prevalence

The Global Insulin Patch Pump Industry is significantly influenced by the rising prevalence of diabetes worldwide. According to recent data, the number of individuals diagnosed with diabetes is expected to reach over 500 million by 2030. This alarming trend is primarily attributed to lifestyle changes, including poor dietary habits and sedentary behavior. As the population of diabetic patients grows, the demand for effective insulin delivery systems, such as patch pumps, is likely to increase. These devices offer a convenient and discreet method of insulin administration, which is appealing to many patients. The increasing awareness of diabetes management and the importance of maintaining optimal blood glucose levels further drive the market. Consequently, The Global Insulin Patch Pump Industry is poised for substantial growth as healthcare providers seek to offer better solutions for diabetes care.

Focus on Patient-Centric Solutions

The Global Insulin Patch Pump Industry is witnessing a shift towards patient-centric solutions that prioritize the needs and preferences of individuals with diabetes. This trend is characterized by the development of devices that are not only effective but also user-friendly and aesthetically pleasing. Manufacturers are increasingly focusing on creating insulin patch pumps that are customizable and can be integrated with digital health platforms. This approach enhances patient engagement and empowers users to take control of their diabetes management. Market data indicates that patient satisfaction is a key driver of product adoption, with studies showing that user-friendly devices lead to better adherence to treatment plans. As healthcare systems worldwide emphasize personalized care, The Global Insulin Patch Pump Industry is likely to benefit from innovations that cater to the unique needs of patients.

Government Initiatives and Support

The Global Insulin Patch Pump Industry is bolstered by various government initiatives aimed at improving diabetes care and management. Many countries are implementing policies that promote the use of advanced medical technologies, including insulin patch pumps. These initiatives often include funding for research and development, as well as subsidies for patients to access innovative diabetes management solutions. For instance, some governments are providing financial assistance for the purchase of insulin delivery devices, which can significantly reduce the burden on patients. Additionally, public health campaigns aimed at raising awareness about diabetes and its management are likely to increase the demand for insulin patch pumps. As governments continue to prioritize diabetes care, The Global Insulin Patch Pump Industry is expected to thrive, driven by supportive policies and increased accessibility.

Technological Advancements in Insulin Delivery

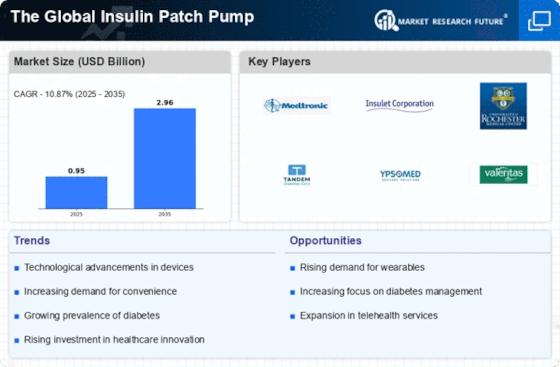

The Global Insulin Patch Pump Industry is experiencing a surge in technological advancements that enhance insulin delivery systems. Innovations such as smart insulin pumps, which integrate with mobile applications, allow for real-time monitoring and adjustments. These devices are designed to improve user experience and adherence to treatment regimens. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This growth is driven by the increasing demand for more efficient and user-friendly diabetes management solutions. Furthermore, advancements in materials used for patch pumps are leading to improved comfort and wearability, which are critical factors for patient compliance. As technology continues to evolve, The Global Insulin Patch Pump Industry is likely to see further innovations that could redefine diabetes management.

Growing Investment in Diabetes Management Technologies

The Global Insulin Patch Pump Industry is experiencing a notable increase in investment directed towards diabetes management technologies. Venture capital firms and private investors are recognizing the potential of innovative insulin delivery systems, leading to a surge in funding for startups and established companies alike. This influx of capital is facilitating research and development efforts, resulting in the introduction of cutting-edge insulin patch pumps that offer enhanced features and capabilities. Market analysts suggest that this trend is likely to continue, as the demand for effective diabetes management solutions grows. Furthermore, partnerships between technology companies and healthcare providers are becoming more common, fostering the development of integrated solutions that improve patient outcomes. As investment in this sector escalates, The Global Insulin Patch Pump Industry is positioned for robust growth, driven by innovation and collaboration.