Rising Investment in Diabetes Care Technologies

Investment in diabetes care technologies is on the rise, significantly influencing the insulin pump market. Venture capital funding and government grants are increasingly directed towards the development of innovative diabetes management solutions. In 2025, it is estimated that investments in diabetes technology will exceed $2 billion in the US alone. This influx of capital is expected to accelerate research and development efforts, leading to the introduction of more advanced insulin pumps. As a result, The insulin pump market is expected to experience a diversification of product offerings, catering to a wider range of patient needs and preferences.

Growing Awareness of Diabetes Management Options

There is a growing awareness among patients and healthcare professionals regarding the various diabetes management options available, which is positively impacting the insulin pump market. Educational initiatives and outreach programs have increased knowledge about the benefits of insulin pumps, leading to higher adoption rates. Recent surveys indicate that nearly 40% of healthcare providers recommend insulin pumps as a viable option for diabetes management. This heightened awareness is likely to drive market growth as more patients seek effective solutions to manage their condition. The insulin pump market is well-positioned to benefit from this trend, as it aligns with the broader movement towards proactive health management.

Enhanced Reimbursement Policies for Diabetes Devices

Enhanced reimbursement policies for diabetes devices are emerging as a crucial driver for the insulin pump market. Insurance companies are increasingly recognizing the long-term cost savings associated with insulin pumps, leading to improved coverage options for patients. Recent changes in reimbursement frameworks have made it easier for patients to access insulin pumps, thereby increasing their adoption. As of 2025, it is projected that over 60% of insurance plans will offer comprehensive coverage for insulin pumps, which could significantly boost market growth. This trend indicates a shift towards supporting advanced diabetes management technologies, further solidifying the insulin pump market's position in the healthcare landscape.

Technological Innovations in Insulin Delivery Systems

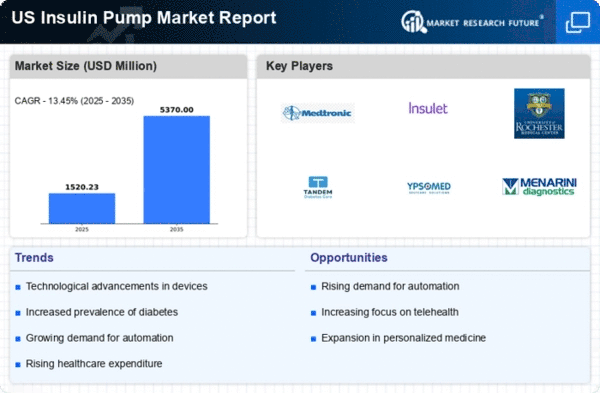

Technological innovations are playing a pivotal role in shaping the insulin pump market. The introduction of smart insulin pumps, which integrate with mobile applications and continuous glucose monitoring systems, is revolutionizing diabetes management. These devices provide real-time data and analytics, allowing users to make informed decisions about their insulin delivery. The market for insulin pumps is projected to grow at a CAGR of 8% over the next five years, driven by these advancements. Furthermore, the incorporation of artificial intelligence in insulin delivery systems is expected to enhance the accuracy and efficiency of insulin administration, thereby attracting more users to the insulin pump market.

Increasing Demand for Personalized Diabetes Management

The insulin pump market is experiencing a notable surge in demand for personalized diabetes management solutions. Patients are increasingly seeking devices that cater to their specific needs, which has led to a rise in the adoption of insulin pumps. According to recent data, approximately 30% of individuals with diabetes in the US are now using insulin pumps, reflecting a shift towards more tailored treatment options. This trend is driven by the desire for improved glycemic control and the convenience that insulin pumps offer. As healthcare providers emphasize individualized care, the insulin pump market is likely to expand further, with manufacturers focusing on developing advanced features that enhance user experience and outcomes.

.png)